Research

June 17, 2021

Child Poverty and The Effects of Anti-Poverty Programs

Executive Summary

- Numerous federal programs aimed at reducing poverty have clearly reduced material deprivation and improved children’s health and educational outcomes; such programs have not, however, adequately improved households’ self-sufficiency to lessen their reliance on the programs.

- The federal Earned Income Tax Credit and Child Tax Credit—both of which, at least until recently, provide a greater benefit as a household’s income increases and thus encourage people to work—are credited with the greatest reductions in child poverty.

- A recent study by the National Academy of Sciences found that expanding the CTC would provide significant reductions in the number of children considered to be in deep poverty, but at the expense of reducing household earnings and employment.

- While reducing material hardship provides immediate relief and benefits, long-term reductions in poverty come from increasing self-sufficiency, which requires full-time employment; policymakers should carefully consider the potential implications of permanently extending reforms to the CTC that lessen the incentive to work.

Introduction

Policymakers’ focus on alleviating child poverty reflects a natural humanitarian desire to help the most vulnerable among us. Achieving this aim also benefits society, since childhood poverty is linked to poverty and other undesirable outcomes in adulthood.[i] In a recent effort on this front, Congress enacted a substantial expansion of the Child Tax Credit (CTC) as part of the American Rescue Plan Act (ARP), explained here, largely on the premise that it significantly reduces child poverty. Notably, these reforms make the credit fully refundable, regardless of income, eliminating the requirement that a family earn a minimum income in order to qualify for the credit.

But what does it mean for a child to be poor? From a technical perspective, poverty is measured based on household income, and as children are generally not themselves earning an income, children are deemed poor if their parents or guardians are deemed poor. Thus, to alleviate childhood poverty, most policies seek to increase household resources. But does increasing household resources necessarily result in more spending on children? Does increased spending result in better outcomes and greater self-sufficiency—the ultimate goals of antipoverty programs?

Previous research by the American Action Forum (AAF) details current poverty rates among the population and finds there are certain characteristics that make children more likely to be impoverished: the younger they and their parents are; if they live with a single mother or un-related individuals; if they live in the South; and if they are Black or Hispanic. But above all, the strongest predictors of child poverty are lower education levels and less than full-time employment for parents.

Knowing that full-time employment is the surest way to escape poverty, increasing the size of the CTC and making it fully refundable regardless of income may have negative long-term repercussions by reducing the incentive to work.

This paper examines the poverty-reducing effects of anti-poverty programs, followed by an analysis of how those programs and the increased resources they provide translate into improved child outcomes, as well as a discussion of the potential implications of the recent CTC reforms.

Impact of Anti-Poverty Programs

Poverty in the United States is primarily assessed via the federal government’s Official Poverty Measure (OPM) and the Supplemental Poverty Measure (SPM), as detailed here. The OPM is essentially a measure of self-sufficiency, while the SPM serves as a proxy for material wellbeing. The difference between the poverty rates as measured by the OPM and SPM is largely due to the value of various government assistance programs. Most reports that state that a certain benefit, income supplement, or tax credit lifts children out of poverty are based on the value of the benefit and whether it increases a family’s income or financial resources enough to move them above the poverty threshold. Simply having more financial resources available to a family, however, is not a guarantee that those resources are being spent on a household’s children and reducing the children’s material hardship. Studies assessing children’s wellbeing and comparing outcomes upon receipt of such benefits—either to before the benefits were available or to similarly situated children who are not receiving such benefits—are better suited for evaluating the impact and value of such programs.

Estimated Reductions in Child Poverty from Various Assistance Programs

Research finds that child poverty (and overall poverty) increases or decreases as expected with changes in economic conditions, with the greatest impacts on those at the lower end of the income distribution, and safety net programs protect against more dramatic impacts than would otherwise occur.[ii] Comparing child poverty rates based solely on private income with poverty rates after accounting for taxes and public transfers shows that tax credits and assistance programs reduce the child poverty rate by more than three times for those in “deep poverty” (where household income is less than 50 percent of the poverty threshold) and by half for those in less severe poverty.[iii]

Refundable tax credits—largely because of their work incentives—have been found to provide the greatest reduction in poverty, particularly as earned income increases and such credits become a greater share of income than in-kind benefits.[iv] The federal Earned Income Tax Credit (EITC)—considered in the SPM but not the OPM—is responsible for an average annual difference between the two measures of 5 million people.[v] It is estimated that 83 percent of EITC benefits are provided to families with children and that 3 million children were lifted out of poverty (using the SPM) in 2018, as a result.[vi] The Census Bureau estimates that refundable tax credits lifted more than 4.7 million children out of poverty in 2018 as measured by the SPM, with the CTC being the other most common credit after the EITC.[vii] Based on these estimates, the CTC alone would be responsible for lifting an estimated 1.7 million children out of poverty—roughly half the impact of the EITC. Columbia University estimates the more generous CTC recently approved will lift an additional 3.9 million children out of poverty completely, while 1.6 million additional children will be lifted out of deep poverty, relative to the previous reforms that were implemented as part of the Tax Cuts and Jobs Act.[viii]

The value of Social Security benefits is estimated to have lifted 21.7 million people out of poverty each year over the past decade; without these benefits, the official poverty rate would have been 17 percent rather than 10.5 percent in 2019.[ix] While children represent a small share of those benefitting from Social Security, such benefits have one of the largest estimated impacts on child poverty: according to the latest SPM report, Social Security benefits lifted 1.4 million children out of poverty.[x]

Supplemental Nutrition Assistance Program (SNAP) and other in-kind benefits (including subsidies for school lunches, housing, and utilities), provide the greatest share of financial resources for those in deep poverty, at least prior to the enactment of the recent CTC reforms.[xi] SNAP benefits reduce the number of people considered poor under the SPM by 2.5 million.[xii] With 44 percent of SNAP beneficiaries being children, it is estimated that SNAP reduces child poverty by 994,000.[xiii] The National School Lunch Program, which exclusively serves children, reduces child poverty under the SPM by 661,000, and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), which primarily serves children, reduces the number of impoverished children by 127,000.[xiv]

Estimated Impacts of Reductions in Child Poverty

While the figures listed above estimate the reductions in poverty based simply on assumptions about the change in a household’s income, the question of whether an anti-poverty program truly benefits children is better assessed by whether child outcomes improve following the implementation or expansion of such a benefit. Numerous studies have found that increasing a family’s income and resources with which to purchase goods has important positive effects on children, including increasing academic test scores, graduation rates, and college attendance, as well as the likelihood that a mother receives prenatal care which decreases the incidence of low-birthweight babies.[xv]

For instance, provision and expansion of the EITC and CTC has been linked to improvements in infant health, as well as higher test scores, high school graduation rates, and college attendance, ultimately increasing hours worked and wages earned by child beneficiaries in adulthood.[xvi]

SNAP has been shown to improve birth outcomes and other health outcomes for children and adults, as well as improve school attendance.[xvii]

Numerous studies show that Medicaid coverage in early childhood is associated with increased educational attainment, greater likelihood of working and higher earnings, and better health in adulthood, relative to being uninsured.[xviii] Effects of Medicaid coverage on poor children, in particular, include significant reductions in child mortality, especially among Black children.[xix] For children in particular, one study found that Medicaid reduced poverty more than “all nonhealth means-tested benefits combined,” reducing child poverty by 5.3 percentage points.[xx] Despite these findings, the value of Medicaid (or any health insurance) is not considered in the poverty measures and thus no impact is shown in the poverty rate from increases in coverage.

The evidence on the effects of housing subsidies is mixed; the biggest positive impacts seem to be from subsidies that allowed families with young children to move to areas with relatively low poverty rates, indicating that it is not necessarily the additional financial resources, but rather the change in location (and often to better schools) that led to improved educational attainment and higher earnings later in life.[xxi]

Overall, the evidence suggests that children benefit from greater household financial resources.

Poverty Trends and Potential Implications of the Reformed Child Tax Credit

Given the evidence of better outcomes for children as resources increase, it may seem intuitive that a richer CTC would also be beneficial. But because of the nature of this particular credit (which until now has encouraged work), the immediate benefits may be at least partially offset by long-term consequences.

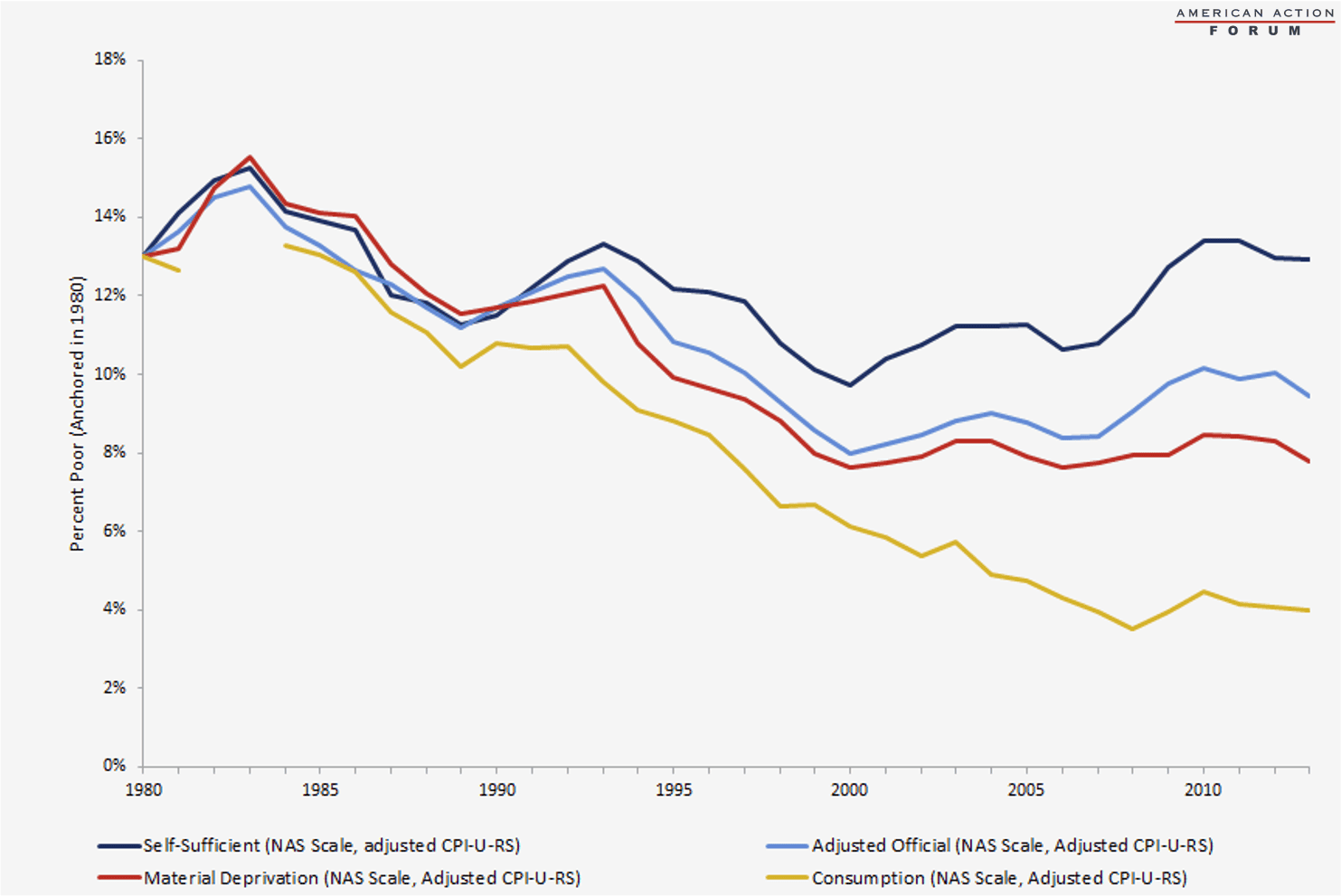

Prior AAF research analyzing material deprivation beyond what is captured by the OPM or SPM reveals that the share of Americans struggling to meet their basic needs has been steadily declining for the past 40 years, reaching just 4 percent in 2013.[xxii] This progress, shown in the chart reproduced below, is largely a reflection of the continued increase in benefits provided over the past several decades as opposed to increased self-sufficiency. Thus, while anti-poverty programs seem to be reducing people’s material hardship, they are not adequately increasing people’s ability to stop relying on such programs. Providing a richer CTC that reduces the incentive to work may simply exacerbate this trend.

The implications of the CTC reforms will likely be greater for those in deep poverty than for those in less severe poverty. In fact, a recent study from the National Academy of Sciences (NAS) found that an expansion of the CTC similar to the expansion implemented by the ARP would reduce the number of people in deep poverty by nearly 50 percent.[xxiii] While such individuals will see the greatest increase in their financial resources, they are also the least likely to be working and thus most likely to be influenced by incentives to work.[xxiv] Reducing the CTC’s incentive to work may slow people’s mobility out of poverty.

Research from the Brookings Institution in 2018 finds that following welfare reforms in 1990 and since, nearly all increases in safety net assistance have been provided to families with earnings, and particularly to those earning above the poverty threshold.[xxv] Medicaid accounts for a vast majority of the increase in per-capita spending on children just above the poverty threshold, followed by the EITC and the CTC. The same research posits that because of the improved outcomes among children who are able to access the increased benefits from these safety net programs, the lack of gains to children below the poverty line may result in long-term negative effects, both for the children and society. The study’s authors argue that while preserving work incentives is “crucial,” the programs that utilize them tend to provide greater benefits to less poor families and children. Thus, the authors suggest that these benefits are not well targeted to those most in need. Further, a work-focused safety net may not provide adequate protection during periods of high unemployment. The authors argue for a more robust safety net for those out of work or facing lost income during economic downturns, noting that the long-term costs of programs that fail to provide such a safety net, particularly for the poorest and youngest children, may exceed any immediate savings. The reformed CTC would partially “correct” this perceived imbalance.

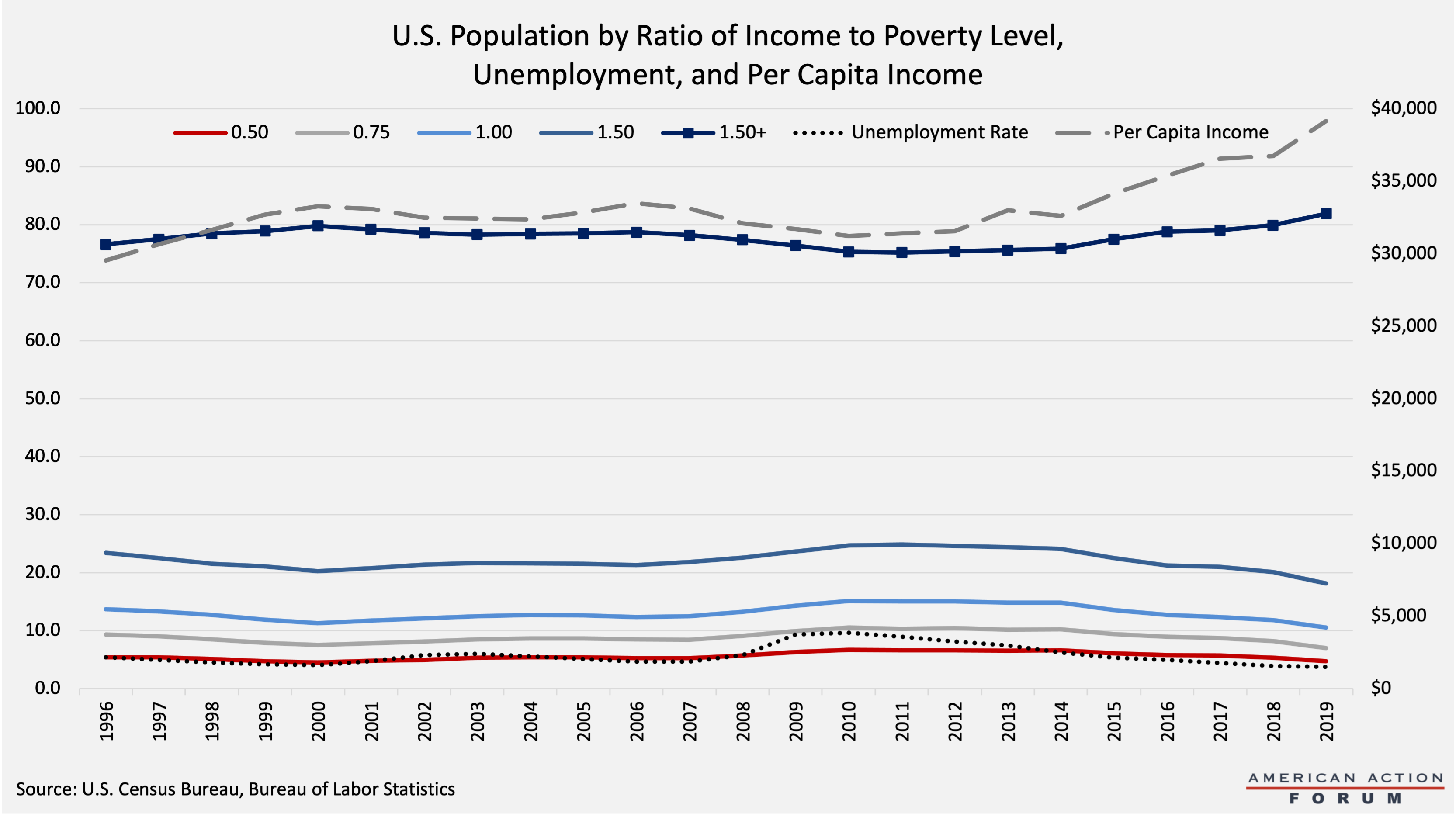

The long-term implications of the more generous CTC, however, are not necessarily positive. Nearly half (45 percent) of those living in poverty are in deep poverty; this share has not changed drastically over the years, but it has declined from 5.4 percent of the population in 1996 to 4.7 percent in 2019.[xxvi] What has more noticeably declined, as shown by the chart below, is the share of the population living below or within 150 percent of the poverty line, consistent with improvements in the unemployment rate and per-capita income. This decline began following the welfare reforms of 1996, leveled off or reversed during the two recessions, and resumed since 2010 as the economy recovered. Thus, while one may interpret the findings of the aforementioned research as the majority of anti-poverty benefits going to the least poor, another interpretation is that those benefits are encouraging people to join the labor force, earn more income and move themselves out of poverty. Still, the share living below the poverty line (like the self-sufficiency rate previously discussed) is not improving at the same rate as per capita income, largely due to growing income inequality.[xxvii] Clearly, there is still more progress to be made, but the imposition of work incentives is not to blame for the lack of progress in moving people out of deep poverty.

Given the clear importance of earned income on an individual’s likelihood of escaping poverty, there is reason to be concerned that recent changes to the CTC will limit its current positive effects on poverty. Expanding the value of the CTC and making it fully refundable to those without any earned income will provide important additional resources for those most in need—but at the expense of diminishing the incentive to work that it currently provides. The NAS report concluded an expansion of the CTC would reduce earnings by nearly $5 billion and employment by more than 100,000 jobs.[xxviii] While the long-term benefits gained from reducing child poverty may outweigh these immediate costs, the long-term costs should also be considered: alleviating material hardship is not as valuable or sustainable as increasing self-sufficiency. At the very least, it is worth studying the impacts of the temporary change on upward mobility and self-sufficiency before enacting a permanent reform. Other reforms studied by the NAS, such as increasing the value of the EITC, show the opportunity for significantly reducing poverty while also increasing employment and earnings and at less than half the cost to the federal budget than the ARP’s CTC expansion.[xxix]

Conclusion

Policymakers have long worked to reduce poverty in the United States, particularly among children. Numerous anti-poverty programs have been implemented over the past several decades, some providing direct cash transfers or tax credits, others providing assistance for the purchase of certain goods. While many of these programs are credited with lifting millions of people out of poverty, the reality is that most simply decrease material hardship without increasing self-sufficiency. Those programs that are associated with increased self-sufficiency are those that incentivize higher earnings, namely the EITC and the CTC. Recent changes to the CTC, and a permanent extension of those changes as is currently under consideration, could undermine those incentives and limit upward mobility. Long-term poverty reduction is best achieved through increased self-sufficiency, and policies that support self-sufficiency, rather than simply reducing material hardship, should be prioritized.

[i] https://www.ncbi.nlm.nih.gov/books/NBK547371/

[ii] Bitler, Hoynes, Kuka, ”Child Poverty, the Great Recession, and the Social Safety Net in the United States.” https://gspp.berkeley.edu/faculty-and-impact/publications/child-poverty-the-great-recession-and-the-social-safety-net-in-the-united-s

[iii] Bitler, Hoynes, Kuka, ”Child Poverty, the Great Recession, and the Social Safety Net in the United States.” https://gspp.berkeley.edu/faculty-and-impact/publications/child-poverty-the-great-recession-and-the-social-safety-net-in-the-united-s

[iv] Bitler, Hoynes, Kuka, ”Child Poverty, the Great Recession, and the Social Safety Net in the United States.” https://gspp.berkeley.edu/faculty-and-impact/publications/child-poverty-the-great-recession-and-the-social-safety-net-in-the-united-s

[v] https://www2.census.gov/programs-surveys/demo/tables/p60/270/Impact_Poverty.xlsx

[vi] https://www.taxpolicycenter.org/briefing-book/what-earned-income-tax-credit

[vii] https://www.census.gov/library/publications/2020/demo/p60-272.html (Appendix Table 7)

[viii] https://www.povertycenter.columbia.edu/news-internal/2019/3/5/the-afa-and-child-poverty

[ix] https://www2.census.gov/programs-surveys/demo/tables/p60/270/Impact_Poverty.xlsx

[x] https://www.census.gov/library/publications/2020/demo/p60-272.html

[xi] Bitler, Hoynes, Kuka, ”Child Poverty, the Great Recession, and the Social Safety Net in the United States.” https://gspp.berkeley.edu/faculty-and-impact/publications/child-poverty-the-great-recession-and-the-social-safety-net-in-the-united-s

[xii] https://www.census.gov/library/publications/2020/demo/p60-272.html (Appendix Table 7)

[xiii] https://fns-prod.azureedge.net/sites/default/files/resource-files/Characteristics2018.pdf, https://www.census.gov/library/publications/2020/demo/p60-272.html

[xiv] https://www.census.gov/library/publications/2020/demo/p60-272.html

[xv] https://www.ncbi.nlm.nih.gov/books/NBK547371/

[xvi] https://www.cdc.gov/policy/hst/hi5/taxcredits/index.html, https://www.cbpp.org/research/federal-tax/eitc-and-child-tax-credit-promote-work-reduce-poverty-and-support-childrens

[xvii] https://www.ncbi.nlm.nih.gov/books/NBK547371/

[xviii] https://www.ncbi.nlm.nih.gov/books/NBK547371/

[xix] https://www.ncbi.nlm.nih.gov/books/NBK547371/

[xx] https://www.healthaffairs.org/doi/10.1377/hlthaff.2017.0331

[xxi] https://www.ncbi.nlm.nih.gov/books/NBK547371/

[xxii] https://www.americanactionforum.org/research/material-well-vs-self-sufficiency-adjusting-poverty-measurements-can-reveal-diverging-trend-america/

[xxiii] https://www.nap.edu/catalog/25246/a-roadmap-to-reducing-child-poverty

[xxiv] https://www.americanactionforum.org/research/poverty-in-the-united-states/

[xxv] https://www.brookings.edu/bpea-articles/safety-net-investments-in-children/

[xxvi] https://www.census.gov/data/tables/time-series/demo/income-poverty/historical-poverty-people.html (Table 5)

[xxvii] https://www.census.gov/data/tables/2020/demo/income-poverty/p60-270.html (Table A-5)

[xxviii] https://www.nap.edu/catalog/25246/a-roadmap-to-reducing-child-poverty

[xxix] https://www.nap.edu/catalog/25246/a-roadmap-to-reducing-child-poverty