Research

March 15, 2023

The Economic and Budgetary Effects of Immigration Reform: S. 744 Revisited

Executive Summary

- In 2013, the Senate passed S. 744 – the Border Security, Economic Opportunity, and Immigration Modernization Act – the closest the United States has come to comprehensive immigration reform in the 21st century.

- Among the projected impacts of S. 744 were more rapid economic growth, increased employment, and reduced federal deficits; if S. 744 were to be enacted as law in 2023, over the next 10 years gross domestic product would be cumulatively $2.9 trillion higher, employment would be 26 million greater, and budget deficits would be reduced by nearly $300 billion.

- If S. 744 were enacted along with pro-investment incentives, real wages would rise for all workers, in contrast to the mixed impacts projected for S. 744 alone.

Introduction

There is renewed policy interest – if not yet sufficient political momentum – in overhauling the U.S. immigration system. Immigration reform is seen as a way to deal with a multitude of issues, ranging from controlling illegal border crossings, addressing the projected slow growth of the population and labor force, providing a path to legal status for those already illegally present in the United States, meeting the need for highly skilled workers, and more.

How would comprehensive reform affect the U.S. economy and federal budget? While not a definitive or comprehensive answer, it is instructive to look at the impacts projected by the Congressional Budget Office (CBO) in 2013 when the Senate passed S. 744 – the Border Security, Economic Opportunity, and Immigration Modernization Act. Although it was not passed by the House of Representatives and did not become law, S. 744 remains the closest the United States has come to comprehensive immigration reform in the 21st century. This short paper translates CBO’s projected impacts of S. 744 from 2013 into projected impacts over the 2024-2033 budget window.

s. 744 in the Current Context

In its analysis, CBO found that S. 744 would raise the population of the United States by roughly 3 percent at the end of 10 years. The labor force would be roughly 3.5 percent larger, the capital stock increased by 2 percent, (total factor) productivity would be raised by 0.7 percent, and gross domestic product (GDP) would be up 3.3 percent. Because capital stock growth would lag behind the growth of the labor supply, average real wages would initially decline before rising overall.

CBO took pains to emphasize that not all workers would see a decline in their real wage; the average decline would be driven by the wage rates of less skilled and experience new immigrant workers. Nevertheless, this finding produced consternation; this issue is discussed further below.

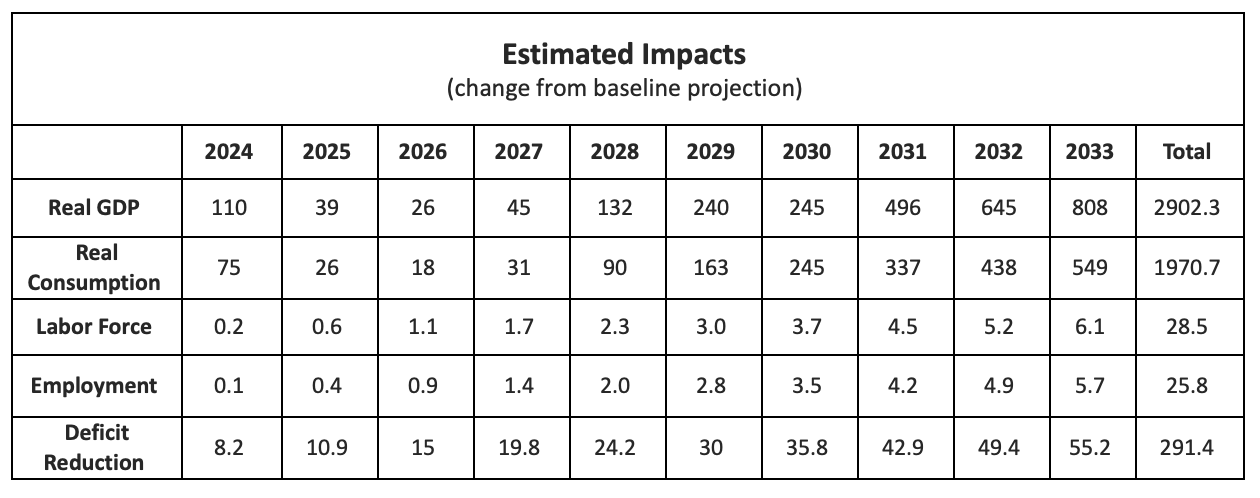

Imagining, for the moment, that S. 744 became law in 2023, the table below translates the impacts into the 2014 budget window. To do so, this study begins with the CBO baseline economic projections released in February 2023 and adjusted using the estimated impacts of S. 744. In addition, it uses the budgetary “rules of thumb” from June 2022 (the 2023 versions are not yet available) to estimate the revenue and outlay impacts.

As the table indicates, the more rapid growth in top-line GDP results in economic activity that is $800 billion higher after a decade and contributes cumulatively $2.9 trillion in additional GDP over the 10-year budget window; it would also finance nearly $2 trillion of additional consumption for households. The more rapid growth is accompanied by a labor force that is (cumulatively) nearly 29 million workers larger and features 26 million more jobs over the 10-year period.

As a result of the faster economic growth, revenues would rise by $425 billion over the 10-year window, exceeding the $133.6 billion in higher federal spending. That yields deficit reduction of nearly $300 billion over the 10-year budget window.

In light of the current challenges facing the economy from inflation, one might hope that the additional labor supply provided by immigration reform would contribute to easing inflation. While directionally correct, the flows over the next year or two are not consequential from this perspective; fighting inflation will remain the bailiwick of the Federal Reserve.

The bottom line is nevertheless straightforward: Immigration reform has beneficial economic and federal budgetary impacts.

Real Wages and Policies to Raise Capital Formation

CBO noted in its original analysis: “CBO’s central estimates also show that average wages for the entire labor force would be 0.1 percent lower in 2023 and 0.5 percent higher in 2033 under the legislation than under current law. Average wages would be slightly lower than under current law through 2024, primarily because the amount of capital available to workers would not increase as rapidly as the number of workers and because the new workers would be less skilled and have lower wages, on average, than the labor force under current law.” Despite this explanation, opponents of reform seized upon the lower average wages.

A straightforward way to address this concern would be to accompany the immigration reform with policies that would improve investment incentives and capital formation. For example, at present several provisions of the Tax Cuts and Jobs Act, including full expensing of investment, have sunset or are schedule to do so over the next several years. Making permanent the tax treatment of investment would reduce uncertainty and improve the outlook for capital formation.

Similarly, budget reforms that reduced future deficits would reduce any possible crowding out of the private sector. One approach that marries immigration and budget reforms is to fund a rapid elimination of the visa backlog; the American Actin Forum’s Gordon Gray estimates this would have beneficial economic and budgetary impacts over the next decade. More broadly, reforms to slow the growth of entitlement spending are essential for the financial sustainability of those programs and reducing future impacts on private sector capital formation.

Conclusion

Immigration reform is long overdue. A reconsideration of S. 744, the last serious attempt at comprehensive reform, indicates that reform would have broad benefits for labor force growth, employment, economic output, and the federal budget.