Week in Regulation

July 29, 2019

Proposed Rules Drive the Week

Last week, the pages of the Federal Register saw quite a bit of activity. The effect on the regulatory budget picture, however, was relatively minimal. The most significant regulatory and deregulatory actions – from the Department of Agriculture (USDA) and Environmental Protection Agency (EPA), respectively – were merely proposed rules. Across all proposed and final rules, agencies published $1.2 billion in total net cost savings but added 3.7 million hours of paperwork.

REGULATORY TOPLINES

- New Proposed Rules: 43

- New Final Rules: 66

- 2019 Total Pages: 36,384

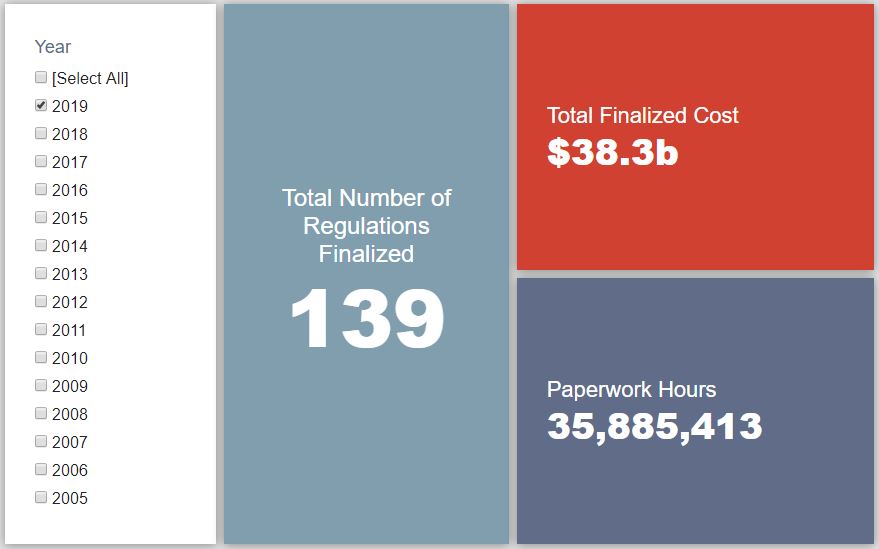

- 2019 Final Rule Costs: $38.3 Billion

- 2019 Proposed Rule Costs: -$2.3 Billion

TRACKING THE REGULATORY BUDGET

The main reason for the net cost savings this past week is the EPA’s proposal regarding “Reclassification of Major Sources as Area Sources Under Section 112 of the Clean Air Act.” This action would allow certain facilities currently deemed “major sources” to shift into the “area sources” category, thereby coming under a less stringent emissions regulation program. EPA estimates that this could cut costs for affected facilities by roughly $2.3 billion (in present value at a seven percent discount rate).

There was, however, also a significant USDA proposal regarding “Revision of Categorical Eligibility in the Supplemental Nutrition Assistance Program (SNAP)” that ate into the EPA’s savings for the week. This rulemaking would tighten certain eligibility requirements for SNAP benefits. USDA estimates that new administrative costs to states and households under these changes reach nearly $1.2 billion. Again though, since both of these actions are still just proposed rules, their totals do not yet affect the fiscal year (FY) 2019 regulatory budget under Executive Order (EO) 13,771.

So far in FY 2019 (which began on October 1, 2018), there have been 54 deregulatory actions (per the rubric created by EO 13,771 and the administration’s subsequent guidance document) against 30 rules that increase costs and fall under the EO’s reach. Combined, these actions yield quantified net costs of roughly $11.4 billion. This total, however, includes the caveat regarding the baseline in the Department of Agriculture’s “National Bioengineered Food Disclosure Standard.” If one considers that rule to be deregulatory, the administration-wide net total is approximately $4.7 billion in net costs. The administration’s cumulative savings goal for FY 2019 is approximately $18 billion.

THIS WEEK’S REGULATORY PICTURE

This week, there was a notable announcement that could have significant ramifications for one of the Trump Administration’s most prized deregulatory action.

The above picture is a passage from the administration’s FY 2019 regulatory budget plan that explains how the “Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule” (the proposal to revise the Obama-era fuel efficiency standards) and its towering cost reductions are expected to be so large that they would skew the overall regulatory budget picture many times over. Last Thursday, however, a group of four automakers and the State of California reached an agreement whereby the automakers would manufacture their vehicles under California’s (more stringent) standards rather than levels expected under the SAFE Rule. Considering that this group contains “about 30 percent of the U.S. auto market,” this could make a serious dent in the project savings under the SAFE Rule.

Indeed, one of the core missions of the SAFE Rule was to pre-empt the establishment of California’s standards and set a single, nationwide set of requirements in order to avoid conflicting requirements. Given the nature of the automotive business and California’s enormous market share, the concern from the relevant agencies was that a California standard could even become a de facto national standard. This agreement is a potential first step in that direction. What will be interesting to see, though, is how this affects projected economic effects of the SAFE Rule.

Similar to how another EPA rule saw significant changes in its baseline assumptions, this announcement (and any further action in the near future) could affect how and why the SAFE Rule is supposed to save money. If 30 percent of the affected market voluntarily forgoes the cost savings in production under the SAFE Rule, how does that affect the overall math? Additionally, by voluntarily taking on the more stringent standards, these automakers are inherently challenging the administration’s underlying assumptions of how much it would actually “cost” such manufacturers to meet a certain efficiency threshold. An imposed cost is generally not readily accepted into a profit-motivated business plan.

Per the most recent Unified Agenda, the SAFE Rule is already well past its expected publication date. One can assume that is due in the near future though. Assuming it is near the end of its rulemaking tunnel, the attending regulatory analyses have likely already been filed. Will the relevant agencies need to re-open such documents in light of this development? And will an updated projection yield a savings estimate that brings this rule down to a more regulatory budget-friendly level? Stay tuned.

TOTAL BURDENS

Since January 1, the federal government has published $36.1 billion in net costs (with $38.3 billion in finalized costs) and 42.7 million hours of net paperwork burden increases (with 35.9 million coming from final rules). Click here for the latest Reg Rodeo findings.