Week in Regulation

March 14, 2022

SEC Proposal Drives Active Week

Last week was a fairly active one on the regulatory front with a dozen rulemakings containing some measurable economic impact. Additionally, after a couple of net-savings weeks preceding it, costs spiked substantially. A Securities and Exchange Commission (SEC) measure on cybersecurity standards for investment advisers provided the vast majority of new burdens. Across all rulemakings, agencies published $2.6 billion in total net costs and added 6.2 million annual paperwork burden hours.

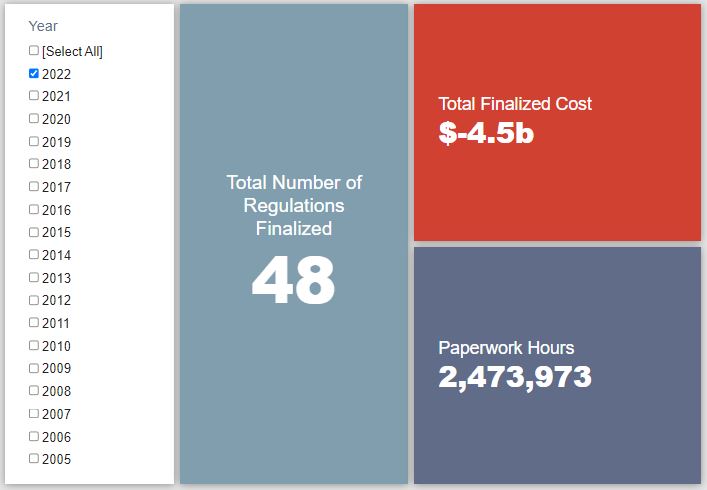

REGULATORY TOPLINES

- Proposed Rules: 35

- Final Rules: 66

- 2022 Total Pages: 14,120

- 2022 Final Rule Costs: -$4.5 billion

- 2022 Proposed Rule Costs: $1.3 billion

NOTABLE REGULATORY ACTIONS

The most significant rulemaking of the week was the SEC proposed rule entitled “Cybersecurity Risk Management for Investment Advisers, Registered Investment Companies, and Business Development Companies.” SEC seeks “to require registered investment advisers (‘advisers’) and investment companies (’funds’) to adopt and implement written cybersecurity policies and procedures reasonably designed to address cybersecurity risks.” According to the rulemaking’s preamble, “these reforms are designed to promote a more comprehensive framework to address cybersecurity risks for advisers and funds.”

This “more comprehensive framework” includes a fairly extensive set of new reporting requirements. Per the proposal’s paperwork burden analysis, the rulemaking could bring nearly 4.1 million of hours of new paperwork each year with commensurate annual costs of roughly $832 million. Extending those costs over the typical 3-year window in which paperwork requirements are officially approved yields $2.5 billion in total costs.

TRACKING THE ADMINISTRATIONS

As we have already seen from executive orders and memos, the Biden Administration will surely provide plenty of contrasts with the Trump Administration on the regulatory front. And while there is a general expectation that the new administration will seek to broadly restore Obama-esque regulatory actions, there will also be areas where it charts its own course. Since the American Action Forum (AAF) RegRodeo data extend back to 2005, it is possible to provide weekly updates on how the top-level trends of President Biden’s regulatory record track with those of his two most recent predecessors. The following table provides the cumulative totals of final rules containing some quantified economic impact from each administration through this point in their respective terms.

![]()

For the first time in weeks, there was some significant movement in the Biden Administration’s final rule tallies. Thanks primarily to a Department of Transportation (DOT) rule on commercial drivers’ safety records, the Biden paperwork total increased by nearly two million hours annually. Interestingly, the rule seeks to cut costs and paperwork burdens, but DOT anticipates “increases in the driver population, the driver turnover rate, and driver wage rates” that will dramatically offset those reductions, leading to such a significant net burden increase.

While the current administration’s lead in that category increased, it did not necessarily widen as compared to the other administrations. This is because the Obama Administration saw its own notable paperwork spike to the tune of roughly 2.7 million hours. A significant SEC rule contributed the vast bulk of that increase.

THIS WEEK’S REGULATORY PICTURE

This week, the omnibus spending bill sets requirements on executive orders.

On March 15, President Biden signed a bill that will fund the federal government for the remainder of fiscal year (FY) 2022, which runs through September 30. The bill included a provision that will affect certain presidential documents issued over that time.

Title II of the bill, covering the “Executive Office of the President and Funds Appropriated to the President,” included language pertaining to executive orders (EOs) – such as the Biden Administration’s latest from this week, pictured above – and presidential memoranda (PAs). These types of documents are methods used by the executive to direct federal agencies through existing authority granted to the president via the constitution or otherwise delegated by Congress.

The legislation would require the Office of Management and Budget to issue an accompanying statement with any EO or PA detailing any “budgetary impact, including costs, benefits, and revenues,” issued in FY 2022. So far, there have been 24 covered documents issued, according to the Federal Register.

Because the language pertains to budgetary impacts, the details of costs, benefits, and revenues appear limited to only those imposed on the government, not the private sector costs like those tracked in AAF’s RegRodeo. Further, it will only require a cost estimate if regulatory costs are expected to exceed $100 million.

The language still presents an interesting case in how Congress can place requirements on executive action. According to the Congressional Research Service, Congress can only repeal or modify the effect of EOs or codify their language through legislation. Since the bill requires an accompanying statement, rather than language in the EO or PA itself, and pertains to the federal budget – something clearly in Congress’s purview – this provision likely would be upheld if challenged in federal court.

TOTAL BURDENS

Since January 1, the federal government has published $3.2 billion in total net cost savings (with $4.5 billion in new cost savings from finalized rules) and 12.4 million hours of net annual paperwork burden increases (with 2.5 million hours in increases from final rules).