Weekly Checkup

February 12, 2021

Biden is Using the Pandemic to Advance His Health Care Agenda

This week Congress began debating in earnest the details of the $1.9 trillion reconciliation bill that is intended to serve as the vehicle for President Biden’s American Recovery Plan. While the legislation has been presented as a direct response to both the COVID-19 public health crisis and the ensuing economic fallout, many of the health-related provisions are at best tangential to the pandemic. Recognizing that legislating in a divided Senate could prove challenging, Democrats are packing many of President Biden’s Affordable Care Act (ACA) related policy initiatives into the reconciliation bill, which can bypass a Senate filibuster.

Three provisions are worth reviewing in some detail. First, the legislation would increase the size of ACA subsidies for individual market health insurance and lift the income cap on who is eligible for those subsidies. Second, the legislation would limit excess premium tax credit recapture. And third, the legislation includes a bizarre effort to treat anyone who receives unemployment assistance as if his or her income were no greater than 133 percent of the federal poverty level (FPL), regardless of actual income, for the purpose of calculating ACA subsidies. Let’s look at each of these in turn.

Under the ACA, a household’s subsidy is adjusted based on income and the cost of the benchmark Silver plan in the rating area. A household’s subsidy must be large enough to ensure that the household does not pay more than a specified percentage of income, relative to the FPL. The reconciliation bill would reduce these percentages substantially in order to increase the size of the premium subsidy for 2021 and 2022, and it would also allow those making more than 400 percent of FPL to receive subsidies for the first time. While these provisions are being presented as a response to the financial hardships faced by households experiencing lost employment due to COVID-19, that justification makes little sense. If it were reasonable for a household making 150 percent of FPL to pay 4.14 percent of its income toward insurance premiums before the pandemic, there is no reason that 4.14 percent of household income would now be unreasonable because of the pandemic. The ACA premium tax credits already become more generous as income decreases, regardless of why the income decreases.

A different provision that is actually related to the pandemic would exempt all excess premium subsidies from recapture for the 2020 tax year. This proposal makes some sense. A household that experienced job loss, resulting in loss of insurance, and that then procured subsidized coverage through the ACA might easily have miscalculated its ultimate income. Clawing back excess subsidy dollars from families and individuals already struggling with unemployment seems excessive under the circumstances.

But then, in a truly bizarre move, the legislation would also require that a household’s 2021 income be assumed to be 133 percent of FPL—regardless of actual income—if an individual in the household qualifies for a week or more of unemployment compensation. To understand this policy, imagine two households with income of 250 percent of FPL in 2021—the first experiencing job loss, and the second not. Under the legislation, the second family would owe 4 percent of household income toward its ACA insurance premium, while the first family with the exact same amount of income would owe nothing because it had experienced job loss. Similarly, a household could ultimately have income in excess of 500 percent of FPL and receive fully subsidized health insurance because of as little as one week of unemployment benefits during 2021. While the provisions around ACA premiums are down payments on a long-held desire on the left to expand the ACA and move toward single-payer coverage, this provision is simply nonsensical as well as unfair.

For the most part, these policies will not address the pandemic or its economic fallout—for a particularly egregious example, note that the bill includes a new $20 million grant program for state-based exchange upgrades. But President Biden and congressional Democrats know that future legislative success is not guaranteed in the 117th Congress, and so they are using the pandemic to advance the president’s broader agenda now.

Chart Review: Where Does the United States Stand on COVID-19 Vaccination?

Ashley Brooks, Health Policy Intern

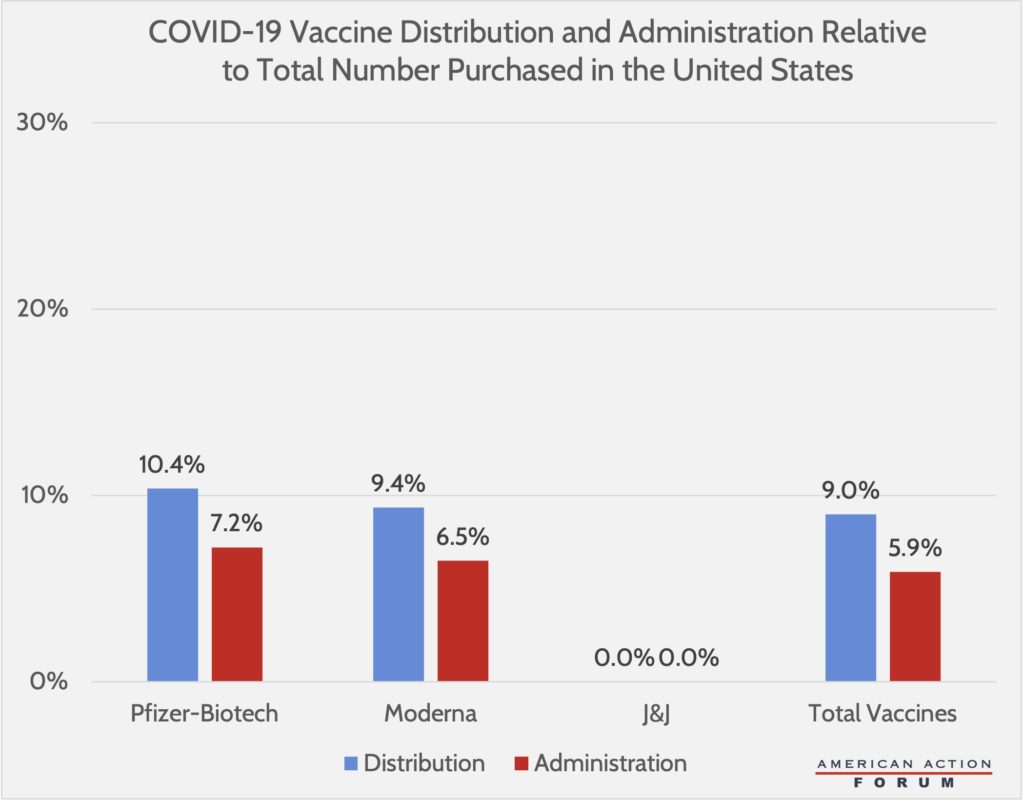

Forecasting vaccine rollout within the United States has been difficult, as pharmaceutical production timelines are not publicly available. Two vaccines have received Emergency Use Authorizations from the Food and Drug Administration (FDA) so far—the Pfizer-BioNTech and Moderna vaccines. Both the Pfizer and Moderna vaccines require two doses to reach their efficacy rates of approximately 95 percent and 94 percent, respectively. While these efficacy rates are high, distribution of the vaccine has remained limited. The United States has purchased 300 million vaccine doses from both Moderna and Pfizer, with full delivery expected by September. Because of the two-dose requirement, these purchases would allow the vaccination of roughly 300 million Americans. Additionally, the United States has already ordered 100 million vaccine doses from Johnson & Johnson, but this vaccine is still awaiting FDA emergency use authorization. Below is an estimation of the progress of the vaccination rollout within the United States. Both administration and distribution are analyzed against the total COVID-19 vaccine allocation by pharmaceutical company. Collectively, about 9 percent of total vaccines purchased by the United States have been delivered, and about 6 percent of the total vaccines have been administered.

Sources: Centers for Disease Control and Prevention Trends in COVID-19 Cases and Deaths in the US, and Trends in COVID-19 Vaccinations in the US

Tracking COVID-19 Cases and Vaccinations

Ashley Brooks, Health Policy Intern

To track the progress in vaccinations, the Weekly Checkup will compile the most relevant statistics for the week, with the seven-day period ending on the Wednesday of each week.

| Week Ending: | New COVID-19 cases: 7-day average |

Newly Fully vaccinated: 7-day average |

Deaths: 7-day average |

|

Feb. 10, 2021 |

104,559 |

347,141 |

2,951 |

|

Feb. 3, 2021 |

134,523 |

432,060 |

3,056 |

|

Jan. 27, 2021 |

161,832 |

300,474 |

3,276 |

Source: Centers for Disease Control and Prevention

Note: The U.S. population is 330,074,711.

From Team Health

Video: The COBRA Subsidy

The Biden Administration is proposing a COBRA subsidy as part of its American Rescue Plan. Christopher Holt explains why this policy doesn’t make sense now.

Podcast: The AAF Exchange — Ep. 62: Under-the-Radar Policy Issues

AAF President Douglas Holtz-Eakin examines a variety of active policy issues that are not gaining much attention, including the push for COBRA subsidies.

The American Rescue Plan and Health Policy

Christopher Holt outlines and assesses the myriad health-related provisions in the American Rescue Plan legislation winding through Congress right now.

Worth a Look

New York Times: ‘A Game Changer’: Drug Brings Weight Loss in Patients With Obesity

Reuters: Recently vaccinated people need not quarantine post COVID-19 exposure: CDC