Weekly Checkup

May 29, 2020

COVID-19, Medicare Advantage, and the Medical Loss Ratio

Even under the best of circumstances, setting insurance premiums can be tricky. Amid a global pandemic, however, it can become downright impossible to correctly rate risk. And it is particularly troubling for insurers who offer Medicare Advantage (MA) plans to the nation’s seniors. MA plans could face penalties for failing to anticipate the pandemic in their 2020 rates, and at the same time they are scrambling to set rates for an uncertain 2021.

The Affordable Care Act established medical loss ratios (MLRs) initially for the commercial and individual markets and later—starting in 2014—for MA plans. An MLR requires that the insurers spend a minimum amount of premium revenue on health care services. In the case of MA, plans must spend at least 85 percent of premium revenue on the provision of health care services. If at the end of the year a plan has spent less than the MLR mandated minimum on health care, the plan must refund the excess premium revenue to the Centers for Medicare and Medicaid Services (CMS). But for MA plans there is an additional penalty. If an MA plan spends less than 85 percent of premium revenue on health care in three consecutive years, that plan is barred from enrolling new beneficiaries the following year, and if it fails to meet the target for five consecutive years, the plan can be terminated by CMS.

Faced with the pandemic, all insurers are confronting two competing challenges in 2020 related to COVID-19 that have upended all their work in 2019 to set appropriate rates. On the one hand, there are the unanticipated costs of testing for and treating COVID-19. According to a March study by Wakely, commissioned by America’s Health Insurance Plans, the total cost of detecting and treating COVID-19 in 2020 and 2021 could range from $56 billion to $556 billion, depending on the scenario used for infection rates. Some plans operating in hard-hit areas could be swamped by the excess costs of responding to the virus. On the other hand, overall health care utilization is down. There are varying estimates of how much utilization has dropped, but recent polling by the Kaiser Family Foundation found that 48 percent of adults reported that they or a member of their household had forgone health care because of the pandemic. The result is that plans with relatively few COVID-19 infected beneficiaries could see their spending on health care services drop dramatically, leaving their total health care spending well below their MLR for 2020. At the same time, insurers are trying to set rates for 2021 without knowing how far into 2021 the pandemic will continue, and with the recognition that at some point in 2021 pent-up health care demands are likely to explode across the system, driving higher than normal utilization separate from the pandemic.

Imagine, then, a scenario where an insurer offers an MA plan in 2019 and ends up spending less than the 85 percent target that year for whatever reason. It refunds the excess premium revenue to CMS and moves on to 2020. But now the pandemic strikes, and beneficiary utilization of health services drops dramatically, leaving the plan under the MLR target once again. Planning for 2021, the insurer anticipates a potential spike in utilization following the conclusion of the pandemic, but utilization in the plan’s patient population doesn’t rise as much as expected. Now the plan has missed its MLR target three years in row, and it is unable to enroll new beneficiaries in 2022 and faces the potential of being terminated thereafter.

There is a larger question of the utility of the sanctions on MA plans for consistently coming in below the MLR target in three and five consecutive years, but setting that aside for the moment, there seems to be a reasonable case for not counting 2020 and potentially 2021 against plans. The COVID-19 pandemic has led to untold disruption, and in general policymakers should prioritize flexibility until the virus has run its course.

Chart Review: Factors Driving Different COVID-19 Outcomes

Andrew Strohman, Health Care Data Analyst

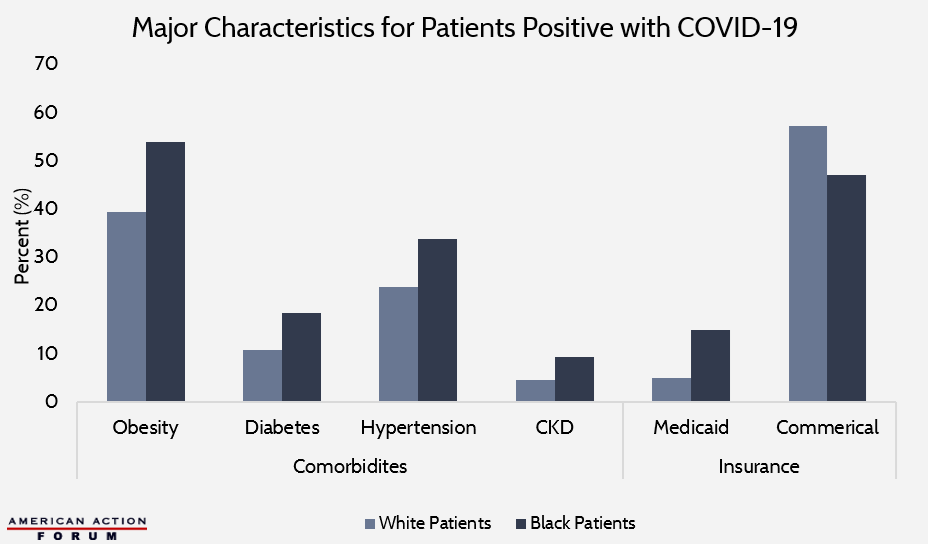

In a recent retrospective cohort study in The New England Journal of Medicine, 3,481 non-Hispanic Black and White COVID-19 patients were studied to understand racial differences in hospitalization and mortality. A wide variety of characteristics—including comorbidities, insurance type, and clinical measures—were investigated, and several models were built to explain their significance in combination. The chart below highlights some of the major descriptive statistics. In addition to having significantly higher prevalence of comorbidities, Black patients also had a lower rate of enrollment in commercial insurance than White patients (47.1 percent versus 57.2 percent, respectively). This difference was almost entirely accounted for by a 10 percentage point higher enrollment rate in Medicaid for Black patients. When both comorbidities and insurance type were included in a model looking at odds of hospitalization, comorbidities were actually found to be statistically insignificant, but those with Medicaid, on average, had 1.65 times higher odds of being hospitalized compared to those with commercial insurance. When evaluating risks of death from COVID-19, race was not statistically significant. As AAF’s Tara O’Neill Hayes and Douglas Holtz-Eakin point out here and here, the reasons for the disproportionate impact of the pandemic on minority communities are complex and multi-factorial, but these findings indicate that a good portion of it impact may be explained through economic, environmental, and access disparities rather than just differences in health status.

Data obtained from the New England Journal of Medicine

From Team Health

Daily Dish: The Facts on China and Pharmaceuticals – AAF President Douglas Holtz-Eakin

The notion that the United States is at the mercy of China, or any other country, for its pharmaceuticals and medical supplies is misplaced.

Video: Is the United States Reliant on China for Medical Supplies? – Director of Immigration and Trade Policy Jacqueline Varas

In this short video, Varas debunks the popular belief that China provides the United States most of its medicines and medical goods but points to where real challenges may lie.

COVID-19: Impact and Response

All of AAF’s analysis on the pandemic and the federal government’s response can be found on this organized dashboard.

Worth a Look

Axios: How the U.S. might distribute a coronavirus vaccine

New York Times: Coronavirus Continues to Disrupt Prescription Drug Supplies