Weekly Checkup

May 24, 2019

On Rebate Rules and Expenditure Estimates

This week the Trump Administration rolled out the Spring 2019 Unified Agenda, a semiannual summation of all the administration’s regulatory activity. Noteworthy for health policy observers, the administration has pushed back to November finalization of the proposed rule on manufacturer rebates for drugs purchased through the Medicare Part D and Medicaid Managed Care program.

Opposition to the proposed rule has focused on the potential increase in costs to the federal government. It is important, however, to recognize just how uncertain the myriad cost analyses of this proposed rule are. AAF’s Tara O’Neill Hayes recently reviewed six cost estimates in detail here, but the key takeaway is that the numbers produced by these estimates depend greatly on behavioral responses that are enormously hard to predict correctly.

First, some background: Currently drug manufacturers provide rebates to Part D plan sponsors, negotiated by pharmacy benefit managers (PBMs). What this means in practice is that, while drug A might have a list price of $200, the manufacturer is giving some of that price back—say, $100—to the plan. Exactly how that rebate is distributed between the plan, the PBM, and the beneficiary is unclear. But both plans and PBMs maintain that the rebates are used to lower Part D premiums for all enrollees in the plan, helping keep Medicare Part D plans affordable.

That’s all well and good, but beneficiaries’ out-of-pocket (OOP) costs are based on the list price. A beneficiary who is prescribed a high-cost drug, is paying co-insurance on the full $200 for their drug, not the $100 negotiated rate. The Trump Administration has proposed requiring that $100 rebate be provided at the point of sale, so that the beneficiaries receive much more benefit from the rebate. As a result, however, those rebates won’t go toward reducing overall premiums for every beneficiary in the plan. It’s conceivable, even likely, that premiums would increase for everyone, while some beneficiaries could receive substantial relief from high OOP costs. And since the federal government pays the bulk of the Part D premium, if premiums increase, the federal government could end up spending more money.

The estimates range from federal savings of $99.6 billion to an additional cost of $196 billion. Why so much variation? As Hayes explains, both insurers and manufacturers want to maintain their current levels of revenue and could respond in a number of different ways in an effort to do so. Additionally, beneficiary behavior is also an open question. Lower OOP costs could increase both medication adherence and overall utilization, which the Congressional Budget Office (CBO) predicts would save money in the other parts of the Medicare program.

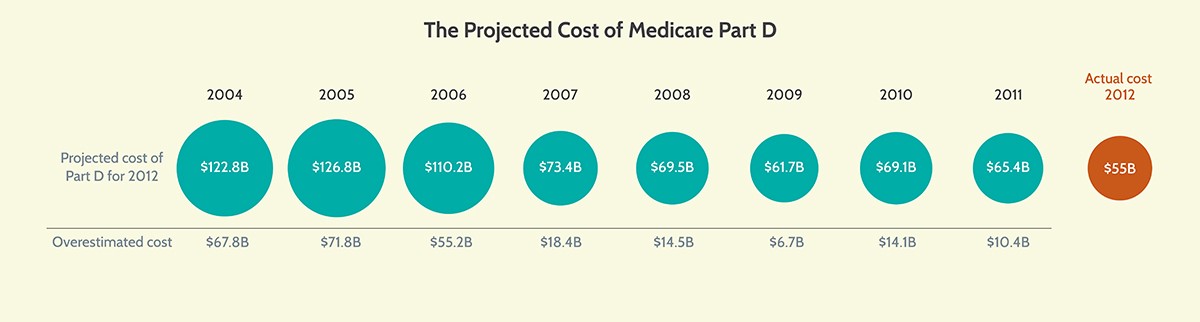

Amid all this uncertainty, recall the original CBO cost estimate for the Medicare Part D program. AAF President Douglas Holtz-Eakin, then-CBO director, signed off on a cost estimate in 2004 that projected federal spending on Part D of $122.8 billion in 2012. The actual cost that year was $55 billion, as demonstrated in the following chart:

CBO’s projections at the time were reasonable and accounted for all the relevant variables, but ultimately, they could not accurately predict the behavioral responses of beneficiaries, plan sponsors, or drug manufacturers to those variables. Cost estimates are important tools, but they cannot be the only basis for making public policy. That’s because they are never entirely correct, and they often are woefully off target. It’s important to keep this reality in mind when evaluating proposals like the administration’s rebate rule.

Chart Review

Kate Dixon, Health Care Policy Intern

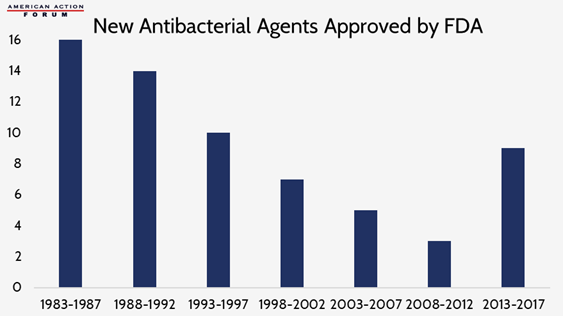

Earlier this year, the World Health Organization released a report demanding urgent action against antimicrobial resistance. The report warned that, without action, drug-resistant diseases will account for 10 million global deaths per year by 2050. While some academics say totally defeating microbial resistance is impossible, it is essential to “keep pace” by limiting the misuse and overuse of antibiotics and encouraging the continuous development of new antibiotics. The low return on investment in antimicrobial development, as discussed in a recent Weekly Checkup, resulted in a large decrease in newly approved agents in the late 1990s and early 2000s, but the Food and Drug Administration has been working with industry to change this trend in recent years. While there has been an increase in approvals in recent years, experts worry this uptick still is not enough to curb the current trajectory of antimicrobial resistant infections and that greater incentives need to be put in place to encourage the development of new agents.

From Team Health

The Drug Rebate Rule: What’s the Budget Impact?

Deputy Director of Health Care Policy Tara O’Neill Hayes highlights the various estimates of the cost of the Trump Administration’s proposed drug-rebate reform.

Worth a Look

STAT News: Google’s AI improves accuracy of lung cancer diagnosis, study shows

Axios: Comcast joins the health tech arena