Insight

May 21, 2019

The Drug Rebate Rule: What’s the Budget Impact?

Executive Summary

The Trump Administration proposed last year to reform how drug manufacturer rebates may be used in the Medicare Part D and Medicaid Managed Care programs. The proposal would require manufacturer rebates be provided at the point of sale, allowing patients to benefit directly from the rebate. Currently, rebates are issued to insurers rather than the patients directly, often resulting in patients paying coinsurance based on the list price of a drug. This proposal would allow patients to pay their coinsurance based on the net price after the rebate.

Numerous actuarial studies were conducted to analyze the potential impacts. The estimates vary significantly as a result of the broad range of assumptions about the likely behavioral responses from the affected stakeholders. The following are some key findings from those studies:

- This rule will result in some degree of increased premiums for everyone, but notable out-of-pocket cost savings for some;

- While around only 30 percent of beneficiaries will likely see net savings, their savings are expected to be so large that the overall beneficiary impact will be a net savings; and

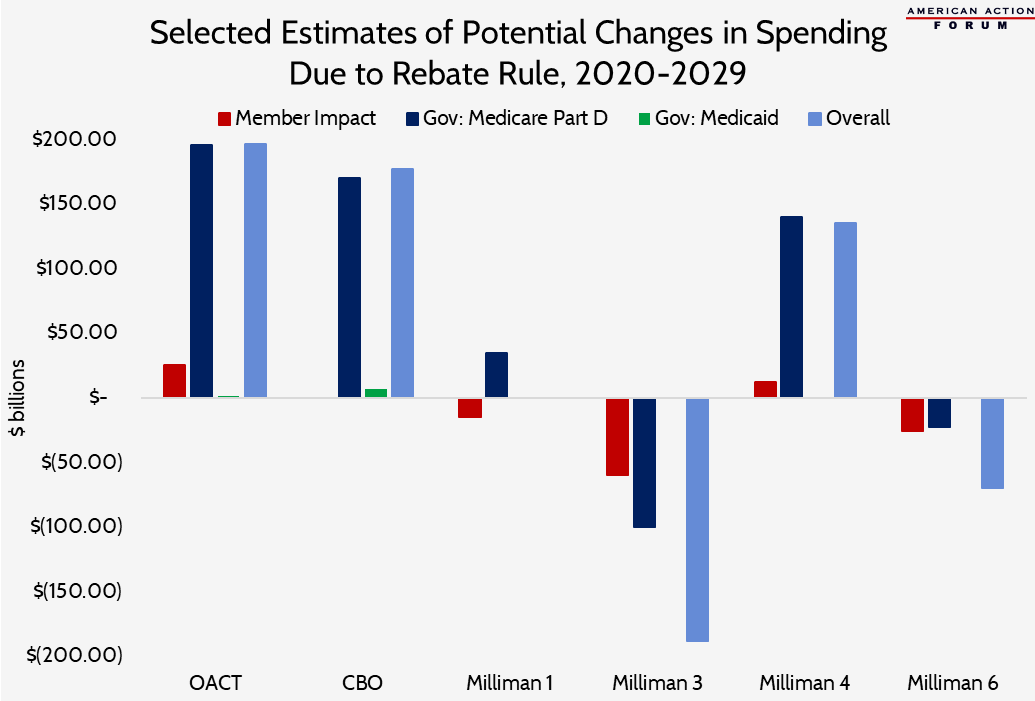

- Cost estimates for the federal government range from savings of $99.6 billion over 10 years to costing the government $196 billion over the same period.

In short: While the overall cost implications of this proposal are mixed since the behavioral responses are difficult to predict, it would arguably redistribute costs more equitably by restoring the fundamental principles of insurance design. Further, this strengthening of the insurance model should provide substantial long-term benefits for the Part D program—by bringing more of the program’s costs under the umbrella of the risk corridors—as well as for beneficiaries who may unexpectedly face higher drug expenses in the future.

Background

Insurance is supposed to spread the risk of unforeseen financial expenses across a large pool of individuals with roughly equal risk. Spreading risk in this way protects individuals from having to bear the full cost of an unexpected, expensive event. Insurance plans typically spread the risk by charging premiums, and the plan then uses that money to pay for individuals’ large expenses. As a result, no one individual will be responsible for the entirety of the cost.

The current structure of most of our health insurance programs, however, does not exactly fit this traditional insurance model, particularly when it comes to the way in which drug manufacturer rebates are used. Drug manufacturers provide rebates—averaging roughly 30 percent—to insurance plans for many of the rather expensive drugs taken by a small percentage of beneficiaries.[1] The common practice now is for insurers to aggregate these rebates and use them to uniformly reduce premiums for all beneficiaries. In other words, rather than reduce the high out-of-pocket (OOP) costs faced by those beneficiaries, insurers instead provide all of their beneficiaries a small piece of the savings through slight discounts in premiums.

Insurance typically targets the benefits to those with the highest costs. Current practice, however, spreads the savings instead, leaving those with the highest costs gaining very little benefit from their insurance policy.

Summary of Various Cost Analyses

Numerous actuarial studies have analyzed the likely impacts of such a policy change. The Centers for Medicare and Medicaid Services (CMS) Office of the Actuary (OACT) conducted a review analyzing its potential impact on the federal government, Medicare beneficiaries, individuals with private insurance, and national health expenditures. The Congressional Budget Office (CBO) considered just the impact to the federal government. The actuarial firms Wakely and Milliman, at the request of the Department of Health and Human Services (HHS), also conducted analyses of possible outcomes; their analyses considered multiple scenarios based on various potential behavioral responses (including no behavior changes). The various findings of these studies are summarized below.

Baseline Scenario: Assuming Existing Rebates Are Replaced 100 percent by POS Discounts (Wakely, Milliman)

In one group of analyses, the actuarial firms Wakely (“Baseline Scenario” in its report) and Milliman (“Scenario 1” in its report) both analyzed the expected impacts of the rule change without any behavioral changes: assuming drug manufacturers continue providing the same value of discounts as currently provided (just at the POS rather than after the fact) and that insurers and patients do nothing differently. As illustrated by these analyses, this change would have significant financial implications for all parties involved, making it highly unlikely this scenario plays out. These analyses, however, provide a helpful starting point from which to assess the more likely possible responses.

Member Costs: Premiums and Cost-sharing

Based on these analyses, beneficiary premiums are expected to increase between $3.15 (Milliman) and $3.73 (Wakely) per enrollee per month in 2020.[2] This increase amounts to $1.8 billion (Milliman) to $2.2 billion (Wakely) in total additional premiums paid by beneficiaries over the course of the year. Both analyses also estimate that average cost-sharing will decrease by more than the estimated premium increase: Wakely estimates cost-sharing will be reduced $5.75 per month in 2020 (for total annual OOP savings for all beneficiaries of roughly $3.4 billion) while Milliman estimates cost-sharing will be reduced by $4.85 per month (for annual total OOP savings of $2.8 billion). On net, under both estimates, beneficiaries are expected to see overall cost savings of 2 to 3 percent, or roughly $2.00 per month in 2020.

Of course, there will be significant differences in the overall impact for various beneficiaries. The good news is that both estimates project that beneficiaries, in the aggregate, will see overall cost savings. Because overall costs vary dramatically across beneficiaries, however, there will be a broad range of impacts among individuals. The majority of beneficiaries are expected to see cost increases because premiums will rise and everyone within the same plan pays the same premium. But not everyone has high OOP costs, or even any OOP costs. Those beneficiaries who take few or no drugs (or otherwise have low OOP costs) will not see significant savings on the OOP side because they’re not spending much to begin with. Further, some beneficiaries taking expensive medications with high OOP costs will, unfortunately, also not benefit from reduced OOP costs because rebates are not provided for every expensive drug or to every insurance plan. That said, for the 30 percent of beneficiaries who are expected by both Milliman and Wakely to have reduced OOP expenses, their savings are expected to be great enough to offset everyone’s increased premiums. Over the course of 10 years (2020-2029), Milliman projects that beneficiaries, on net, will save $14.5 billion under this scenario with no behavioral changes.

Milliman also notes in their analysis that there is the potential for beneficiaries to see cost-savings even if they don’t take a medicine for which a rebate or discount is being provided. Plans may need to reduce the cost-sharing amount for other medicines in order to maintain the minimum actuarial value required of Part D plans, which will be affected by the reduction in the POS cost of brand medicines.

Government Costs: Direct Premium Subsidies, Reinsurance, and Low-Income Cost-sharing Subsidies

The federal government subsidizes roughly three-quarters of the Part D program’s costs, and therefore any change in the financing structure of the program will likely impact the federal government significantly. The government’s subsidy is comprised of two primary components: a direct premium subsidy, covering 74.5 percent of the basic premium, and a reinsurance subsidy, covering 80 percent of the costs in the catastrophic phase of the benefit. The government also provides additional subsidies for low-income individuals, covering a significant share of the premium and cost-sharing that such beneficiaries would otherwise owe. Roughly 28 percent of beneficiaries qualify for the low-income subsidy (LIS), and in 2018 the government spent roughly $29 billion here, nearly five-sixths of which is for beneficiary cost-sharing.[3]

According to the Wakely analysis, total government costs under this baseline scenario would increase in 2020 by 3.3 percent, or $8.39 per enrollee per month, which would amount to roughly $4.9 billion in total annual cost increases. Milliman similarly estimates overall costs will increase by 3 percent, but because its model includes lower base premiums, this increase amounts to just $4.93 per member per month, or $2.8 billion in total. The two analyses project the basic premium subsidy will increase by 144 to 145.5 percent (roughly $15 billion in 2020), while the LIS premium subsidy is projected to increase between 8 (Wakely) and 12 percent (Milliman). Conversely, reinsurance costs are expected to decline in 2020 by between $7.3 billion (Wakely) and $12.7 billion (Milliman), while low-income cost-sharing subsidies are expected to decline by between $4.2 billion (Wakely) and $5.8 billion (Milliman). Milliman estimates that over the course of 10 years, the federal government would face increased costs of $34.8 billion, if no behavioral changes occur.

Alternative Scenarios, Assuming Various Behavioral Changes

Reduced Price Concessions Relative to Existing Rebate Value: 90% (Wakely), 85% (OACT, CBO), 80% (Milliman)

Several analyses were done based on the assumption that manufactures would continue to provide some, but not all, of the value of the existing rebates under the new rules. Part of the rationale for this assumption is based on the way many manufacturers determine rebate amounts: Drug manufacturers often decide how much of a rebate to provide for a given drug based on the volume of sales for that drug to a plan’s beneficiaries. In essence, the more people enrolled in a given insurance plan that take a certain drug (either in nominal terms or relative to a competitor), the greater the rebate. This approach requires knowledge of the volume of sales; thus, rebates are typically provided after the year’s end. Providing rebates at the time of the sale provides the drug manufacturer less ability to ensure they get their desired sales volume; thus, they may be less likely to provide such a significant discount.

Wakely did an analysis based on 90 percent of the rebate value being maintained, along with various other changes (Scenarios 1-4). Both CBO and OACT predicted that the value of discounts would equal 85 percent of the existing rebates. Finally, Milliman (Scenario 4) did an analysis assuming discounts would equal 80 percent of the current rebate value. The potential impact of the rule in these analyses ranges from overall cost increases of $135 billion to $196 billion over the 10 year window. The cost to the federal government is projected under these analyses to increase between $139.9 billion (Milliman) and $196.1 billion (OACT). The cost to beneficiaries may rise by as much as $12.3 billion (Milliman) or fall by as much $25.2 billion (OACT). (CBO did not estimate potential impacts to beneficiaries.)

The Wakely analyses assuming discounts equal to 90 percent of their current value found that beneficiaries’ overall costs would fall in 2020 by between 1.9 percent and 3.5 percent, while government costs would increase by an estimated 2.9 to 3.8 percent. Further, drug manufacturer outlays would be reduced by roughly 30 percent.

CBO estimates that drug manufacturers will provide point of sale (POS) discounts equal to 85 percent of the value of current rebates. Under its analysis, doing so would result in increased federal spending of $177 billion over the course of 10 years; $170 billion in increased expenditures for Medicare Part D and $7 billion for Medicaid. The majority of the increased cost for Part D would stem from the rise in premiums, which the government subsidizes at a rate of 74.5 percent. Reinsurance costs would likely be significantly reduced, as CBO expects the growth in per capita expenditures would be reduced 14 percent, which would slow the growth rate of the various coverage thresholds by the same amount.

CBO also notes that the change would likely increase utilization of expensive medicines, but projects that the medical savings to Medicare Parts A and B that would accrue as a result of better medication adherence would actually be worth twice as much as the likely increased drug costs ($20 billion in medical savings, compared with $10 billion in increased Part D expenditures). CBO also estimated the temporary change to the Part D risk corridor program recently announced by HHS would likely cost the federal government $10 billion. Regarding Medicaid, CBO expects drug manufacturers would reduce the supplemental rebates they pay by 75 percent because Medicaid beneficiaries already pay so little in OOP costs that the potential gain for beneficiaries is much less significant; this decrease in rebates would increase federal costs by an estimated $1 billion. Further, if the discounts provided in Part D are included in a drug’s calculated average manufacturer price (AMP), then the mandatory rebates drug manufacturers are required to pay for drugs taken by Medicaid beneficiaries would be reduced by $6 billion because the rebate amounts are calculated as a percentage of AMP.

OACT also assumed that drug manufacturers would reduce the value of the discounts they currently provide by 15 percent. Of the remaining 85 percent of existing discounts, OACT believes 75 percent of that value would be provided in the form of POS discounts and 25 percent would be provided through reduced list prices. In other words, POS discounts would equal 63.75 percent of the current value of the rebates provided and list price reductions would be equal to 21.25 percent of existing rebates. This translates into a 3.2 percent reduction in list prices for brand-name drugs. In total, OACT projects these changes would increase federal expenditures by $13.5 billion in 2020 and $196 billion from 2020-2029. The government’s direct premium subsidy is projected to increase $258.7 billion, and the low-income premium subsidy would increase $15.4 billion over the 10-year window. These cost increases would be slightly offset by a $20.3 billion reduction in reinsurance costs and a $57.7 billion reduction in LIS cost-sharing subsidies. Beneficiaries are expected to see overall savings of $25.2 billion, though these savings will be highly concentrated among a minority of enrollees. Premium increases will total $58 billion over the 10 years, offset by cost-sharing reductions of $83.2 billion. Manufacturers would pay $39.8 billion less in coverage gap rebates.

Milliman modeled a scenario in which price concessions equal only 80 percent of the current value of rebates (Scenario 4). Under this scenario, overall expenditures for Part D would increase $135.1 billion over 10 years. Beneficiaries would only bear a slight share of those cost increases: $12.3 billion on net, with OOP reductions totaling $32.6 billion, but premium increases equaling $44.9 billion. The federal government would pay $241.6 billion more in premium subsidies (including the extra subsidy for LIS beneficiaries) and save $30.2 billion in reinsurance costs and $71.4 billion in reduced cost-sharing expenses for LIS enrollees. Drug manufacturers would spend $17.1 billion less.

Reduced List Prices (Milliman, OACT)

Two other analyses considered the possibility that drug manufacturers would reduce their list prices as a result of this rule, which is part of the objective. Reduced list prices would benefit everyone taking the drug, not just Medicare and Medicaid beneficiaries.

The OACT analysis, as previously stated, is based on an assumption that this rule would lead to manufacturers providing discounts and price concessions equal to 85 percent of the rebates they currently provide, and that three-quarters of the new discounts would take the form of POS discounts and one-fourth would be in the form of reduced list prices. According to OACT, this would result in a reduction of brand drug list prices of 3.2 percent across the entire U.S. market.

An interesting takeaway from OACT’s analysis is that, based on its assumptions, non-Medicare beneficiaries would actually fare slightly better as a result of this policy change, while Part D beneficiaries would largely be worse off. The net price for a hypothetical brand-name drug would be reduced by 1.7 percent for non-Medicare beneficiaries, while the net price would increase by 6 percent for Part D enrollees. Further, Medicaid savings from reduced list prices would be more than offset by the reduced mandatory rebates that would result, increasing Medicaid’s costs by $500 million over 10 years. Medicare Part B savings may be able to make up for those increased Medicaid costs: OACT estimates that there is the potential for roughly $500 million in savings for Part B drugs that are also covered under Part D and for which significant rebates in the Part D space already exist. These savings would result from a reduction in the Average Sales Price, which is used to calculate the reimbursement rate for such drugs covered under Part B.

Milliman analyzed a scenario in which brand-name drugs’ list prices were reduced—or at least, not increased as much as otherwise expected (Scenario 5)—as well as a scenario where those price reductions led to increased utilization (Scenario 6), which is certainly a likely outcome. Under these two scenarios, Milliman assumed list price increases for brand-name drugs would be 1 percent lower annually; in Scenario 6, Milliman assumed this slower price growth would increase utilization for such drugs by 0.5 percent.

Reduced list price growth (Scenario 5) is projected to reduce member cost-sharing by $46.5 billion; member premiums would still increase by $13.3 billion for an overall cost-savings to beneficiaries of $33.1 billion form 2020-2029. The government would also see total savings under Scenario 5 of $38.4 billion over that period, with savings coming from reduced reinsurance payments ($154.6 billion) and reduced low-income cost-sharing subsidies ($101.3 billion), and the biggest cost increase resulting from higher premium subsidies ($217.5 billion, including the LIS premium subsidy). Total program savings would equal $94.3 billion. When increased utilization is accounted for (Scenario 6), total program savings are reduced to $69.9 billion over 10 years. Beneficiaries would see overall savings of $26 billion, with slightly less savings in OOP expenses ($42.7 billion) and slightly higher premium increases ($16.7 billion). On a per beneficiary basis, members would see an average reduction in cost-sharing expenses of $58.68 in 2020 and an annual premium increase of $35.76 under this scenario. The federal government would save $22.7 billion, paying $222.4 billion more in premium subsidies and $143.8 billion less in reinsurance costs and $101.3 billion less in low-income cost-sharing subsidies under Scenario 6.

Increased Formulary Controls and Greater Price Concessions

Milliman also analyzed several other possibilities; more details regarding the potential impacts of these scenarios can be seen in their report. The second scenario analyzed by Milliman is one in which insurers increase formulary controls, giving greater preference to generic drugs and likely increasing use of step-therapy and prior-authorization requirements. This scenario, according to Milliman, would yield $164.6 billion in overall program savings over 10 years, with beneficiaries saving $56.2 billion and the government saving $78.8 billion. The third scenario analyzed by Milliman assumes this response encourages manufacturers to increase their price concessions, relative to the value of the rebates they’re currently providing. The theory is that if insurers tighten access to more expensive drugs, manufacturers might provide greater discounts in order to keep their drugs on formulary. This scenario would yield the greatest savings of any of the estimates, according to Milliman: Overall savings of $188.2 billion, with beneficiaries spending $59.5 billion less and the government spending $99.6 billion less.

Lastly, Milliman analyzed a scenario (Scenario 7) in which insurers and pharmacy benefit managers (PBMs) will try to increase pharmacy rebates, since these rebates will still be treated as direct and indirect remuneration (DIR) and can be used to lower premiums (manufacturer rebates are currently also considered DIR, but pharmacy rebates would still be allowed under this rule). Under this scenario, Milliman expects beneficiaries to save $18.1 billion, but government costs would increase by $17.8 billion over ten years. This assessment aligns with prior research from CMS showing that insurers benefit much more from DIR than the government.[4]

Behavioral Responses Will Determine the Impact

The most important factors in all of the analyses are the assumptions about the behavioral changes. Any change in policy of this magnitude all but guarantees the parties impacted will adjust their behavior; the only question is: In what way, and by how much? It is not possible to know in advance—hence, the assumptions. But the bottom line is, both insurers and manufacturers will try to maintain their current revenue levels. How might they do that? And how will their actions affect government spending, insurance premiums, and list prices?

Government spending and Part D premiums are inextricably linked—the government covers three-quarters of their cost. And it is almost guaranteed that premiums will rise in response to this change because the current practice that is used to help keep premiums low will no longer be allowed. But the government also heavily subsidizes the costs of the most expensive patients (through reinsurance) and the cost-sharing liability of low-income beneficiaries, and both of these costs will be reduced as a result of this change. Ultimately, whether the federal ledger either worsens or improves depends on whether the savings in reinsurance and cost-sharing subsidies are enough to offset the premium subsidy increases.

For years drug manufacturers have blamed their increasing list prices on the rebate system. They have argued that patients aren’t benefitting from the rebates they provide because the insurers and PBMs keep some of the money for themselves and use the rest to provide small premium savings. The theory behind this policy change is that if the rebates have to be provided at the POS, the PBMs and insurers will no longer value higher-priced, high-rebate drugs over lower priced drugs, which should help bring down list prices. If list prices don’t come down, proponents argue, at least the patients taking the most expensive medicines will see substantial OOP savings. Whether list prices come down likely depends on whether this policy is extended to the commercial market, which would require congressional action. Whether the value of the discounts provided equal the value of existing rebates likely depends on the competitiveness of a drug class and a manufacturers’ confidence in their ability to maintain market share.

A number of analyses assessed the possibility that manufacturers reduce the value of the discounts they provide relative to the value of existing rebates. This reduction could occur as a result of the fact that manufacturers will no longer be able to guarantee that certain market-share or volume metrics have been met before providing a discount and thus may be less willing to provide as great a discount upfront.

CBO, OACT, and Milliman all comment on the fact that manufacturers might choose both to reduce their list prices by a small margin and also to reduce the value of the POS discount relative to the rebate. Manufacturers would likely make this trade-off recognizing the public pressure to reduce list prices while simultaneously wanting to maintain the status quo in terms of net revenue per drug sold. List prices are unlikely to be reduced significantly because this rule change would only apply to the Medicare Part D and Medicaid MCO markets, and not the commercial market. Because there can only be a single list price for a drug, any reduction to list price will impact every market. Thus, in the commercial market where the same rules don’t apply, a reduced list price could significantly reduce a company’s revenue if they don’t also reduce the value of the rebates they provide. Reducing the value of the rebates, however, could result in the loss of favored formulary status if a competitor maintains their high list price and larger rebate amount.

Insurers will try to maintain revenues by not allowing the net price of what they pay for drugs to increase. Insurers will also be playing a difficult balancing act with regard to the premium they set for their plans. While premiums will have to increase, as discussed, insurers will likely do everything in their power to minimize that increase. Insurers know the importance of keeping premiums as low as possible in order to attract enrollees. Insurers also often try to keep their premium low enough to qualify as an LIS benchmark plan, which means LIS beneficiaries can enroll in their plan at no-cost. Because insurers have limited liability for LIS enrollees, plans are eager to enroll them. In order to control costs and keep premiums as low as possible, insurers will likely increase their negotiating efforts and impose greater formulary controls and utilization management tools.

There is also the possibility that reduced beneficiary OOP costs would lead to increased utilization. While increased utilization would diminish the potential savings on drug expenditures, it would likely have two positive impacts. One, there is little chance that the increased utilization would be the result of people taking unnecessary medication; it is much more likely that beneficiaries would be taking medicines that they would have been taking if they had been more affordable. This increased adherence will likely improve beneficiaries’ management of chronic conditions, treatment of acute conditions, and even produce savings on the medical side of the ledger: CBO anticipates that increased medication utilization costs will produce twice as much in savings in Medicare Parts A and B by keeping people out of the hospital and doctor’s office.

Long-Term Impact to the Part D Program

A final point to consider regarding the potential financial impact of this policy change is a longer-term impact that was not examined in these 10-year studies: the impact of the Part D risk corridors. Because this policy change will result in more of the program’s costs being covered by premiums rather than reinsurance, more of the program’s costs will be subject to the program’s risk corridors. Recent analysis has shown that as more of the program’s costs have occurred in the catastrophic phase—80 percent of which is covered by the federal government through reinsurance—the overall program subsidy has exceeded the target of 74.5 percent. This excessive growth has occurred because reinsurance costs are not subject to the protections and liabilities of the risk corridors. Some Part D plan sponsors have figured out how to bid so that they receive more subsidy dollars than they otherwise would by overestimating the “basic benefit” portion of their bid and underestimating their catastrophic costs. By having more of the program’s costs covered by premiums and less in the catastrophic phase, it is less likely that the federal government’s overall subsidy will exceed its target amount.[5] As a result, this reform could better contain the program’s costs long-term than the current structure.

Conclusion

There are a broad range of estimates for how this proposed rebate rule would impact drugs’ list prices and what the government and patients ultimately pay for those drugs and the insurance coverage for them. The breadth of potential impacts is largely due to the wide variety of assumptions made about how the various stakeholders will respond to this new policy. Further, some of these analyses are more conservative and narrowly focused, while others are more bold and comprehensive. The estimates range from potential overall net savings of $188.2 billion over 10 years, to potential overall net costs of $135.1. CBO and OACT estimate cost increases to the federal government could be as high as $177 billion and $196.3, respectively, between 2020 and 2029. OACT estimates that after accounting for any potential savings, total national drug expenditures could increase by $137 billion over those 10 years. While these estimates could cause cost-conscious policymakers to pause and consider whether this is a worthwhile change, alternative estimates demonstrate the potential of equally large savings.

Further, one shouldn’t get bogged down in a single aspect of a policy change. There are a multitude of factors to consider, and it’s important to keep the goals in mind. It is also important to remember that while there are likely to be many goals, it is typically difficult to achieve all goals with a single policy change like this one. The “drug pricing problem” is neither a singular nor a universal problem. There are multiple problems that need to be addressed and they will require multiple policy changes. This policy change can help solve one of those problems: Reducing extremely high OOP costs for many of the small handful of beneficiaries facing high costs.

While the majority of beneficiaries would be made relatively worse off as a result of this change, relative to the status quo, it is not hard to see how the current system inappropriately advantages the majority. This policy change would undo that advantage. Further, nearly all analyses project that the benefit expected to be gained by the few with high OOP costs will outweigh the small additional cost that many will face. Last, there are a number of beneficiaries who may seem worse off in the near-term because of this policy but who would benefit in the future when their health takes an unexpected turn for the worse. Such risk mitigation is precisely what health insurance is supposed to provide.

[1] https://www.iqvia.com/institute/reports/medicine-use-and-spending-in-the-us-review-of-2017-outlook-to-2022

[2] The dollar-value of the Wakely estimate in premium increases is higher than the dollar-value of the Milliman estimate despite having a significantly lower estimate on a percentage basis because the Wakely estimate is based on an initial premium that is nearly twice that of the base premium in the Milliman study. Each firm uses their own data obtained both through CMS as well as that of their own clients to build their models and make estimates, resulting in differences such as these.

[3] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/downloads/tr2018.pdf

[4] https://www.cms.gov/newsroom/fact-sheets/medicare-part-d-direct-and-indirect-remuneration-dir

[5] https://www.americanactionforum.org/insight/evidence-for-structural-reform-part-d/