Weekly Checkup

August 12, 2022

Prepare To Be IRA-te

After a sleepless weekend for the U.S. Senate, Democrats were finally able to pass a reconciliation bill by a slim margin of 51-50; the House is expected to pass it sometime today. The legislation, known as the Inflation Reduction Act (IRA), is a slimmed-down version of the original Build Back Better Act (BBBA). No, the IRA isn’t the behemoth $1.6 trillion “transformational” package once promised by the Biden Administration, but make no mistake: This bill is extraordinarily consequential and will have impacts far beyond the 10-year Congressional Budget Office (CBO) score. Below, is a review of the major health pieces of this legislation (AAF’s in-depth explanation of the IRA’s provisions can be found here), as well as their consequences.

First, there are the extensions to the Affordable Care Act’s (ACA) premium assistance tax credit boost first established in the American Rescue Plan Act at the height of the pandemic. Essentially, these tax credits prevent anyone using the ACA exchanges for health insurance from paying more than 8.5 percent of their income on premiums. Premium assistance will decrease as income increases but will still be available even to those making more than 400 percent of the federal poverty level. The IRA extends this pandemic-era “temporary” premium assistance for three more years. Failure to extend these credits would simply return premium assistance levels to those of the pre-pandemic era, but in three years’ time you should expect to hear the same warning sirens from the left that we “have to” extend the assistance yet again.

Second, Medicare will institute a price-setting scheme for drugs. The legislation calls this “negotiation,” but as I covered in a previous Weekly Checkup, it’s not a negotiation when one party can’t say no to entering “negotiations” in the first place, reject the final offer, or seek recourse in civil courts. Pharmaceutical manufacturers are going to make up for the price cuts they face in Medicare Parts B and D in one of three ways: cutting research and development budgets, raising prices in the private market, or pulling drugs out of the Medicare program. The IRA also includes inflation penalties on drugs sold in Medicare whose average manufacturer price outpaces inflation, yet another way to dictate prices. Adding to the bill’s woes is a $35 monthly co-pay cap on insulin for Part D beneficiaries, creating yet more negative externalities.

The last major health provision in the IRA is the Part D redesign. The restructuring isn’t a terrible idea; a similar concept was proposed by AAF back in 2018. The IRA’s redesign would eliminate the coverage gap and any out-of-pocket cost sharing by beneficiaries in the catastrophic coverage phase, reduce Medicare re-insurance in the catastrophic phase from 80 percent to 20 percent for most drugs, and have manufacturers cover 20 percent of the costs of most drugs in the catastrophic phase, with insurers covering the rest. Again, the overall structure of the redesign isn’t awful, but it is unfortunately paired with a “temporary” (for CBO score-rigging purposes only) cap on the year-to-year increases of Part D premiums for 2024–2029.

A few other items of note are included, such as the repeal of the never-implemented 2019 Drug Pricing Rebate Rule (which, in the grand tradition of Congress, is “reducing” the deficit by canceling future plans to spend more). Despite the Part D restructuring, the IRA is a rough piece of policy overall. It puts expensive, temporary policies on a path to permanent status and creates a drug pricing policy that is guaranteed to lead to fewer cures, less innovation, and higher private-sector prices. It’s enough to make any dedicated policy wonk IRA-te.

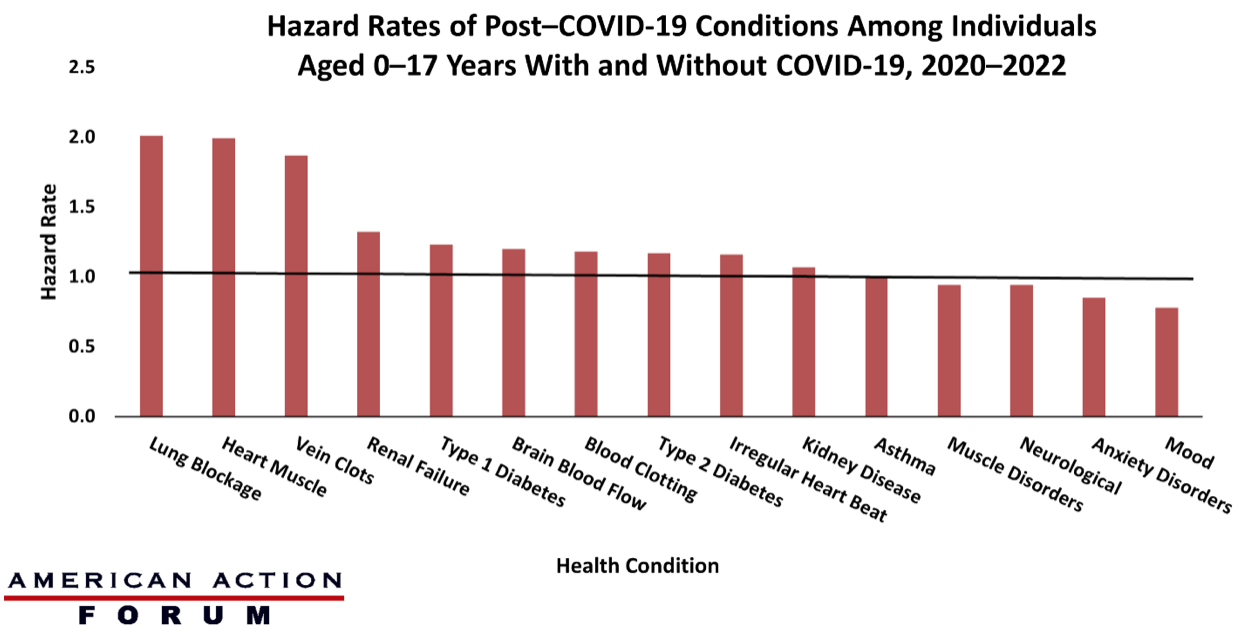

Chart Review: Hazard Ratios of Post-COVID-19 Health Conditions, 2020–2022

Evan Turkowsky, Health Care Policy Intern

On August 5, the Centers for Disease Control and Prevention (CDC) released its report on the hazard ratios among children and adolescents aged 0–17 years, comparing those who had COVID-19 to those who did not from March 2020 to January 2022. Hazard ratios show how often a condition occurs in one group compared to another group over time. A hazard ratio of one means there is no difference in occurrence between two groups, while a hazard ratio greater than or less than one means occurrence was higher in one of the groups.

The study identified several conditions with elevated hazard ratios among patients who contracted COVID-19. As illustrated in the chart below, individuals who had COVID-19 nearly doubled their chances of acute pulmonary embolism (2.01), myocarditis and cardiomyopathy (1.99), and venous thromboembolic – a vein clotting condition (1.87), all of which were rare or uncommon in the study population. Conversely, conditions that were most common in the study population, such as mental health conditions, neurological conditions, and muscle disorders, had lower hazard ratios (near or below 1.0), with asthma showing no difference between the two groups. This report highlights the potential long-term health conditions that can arise due to COVID-19 infection.

Data Source: The CDC and HealthVerity