Insight

April 17, 2023

FTC and Congress Put PBMs on Notice

Executive Summary

- In June 2022, the Federal Trade Commission (FTC) launched a fact-finding mission into the business practices of pharmacy benefit managers (PBM); just nine days later, the agency declared a ramp-up of enforcement against allegedly illegal PBM rebate schemes.

- Separately, the Senate is debating the Pharmacy Benefit Manager Transparency Act of 2023, which would prohibit certain PBM activity and grant the FTC greater regulatory power.

- The FTC’s decision to ramp-up enforcement and the Senate’s rush to legislate prior to the FTC study’s conclusion risk policy missteps in the complex prescription drug supply chain that could reduce competition and ultimately increase patient costs.

Introduction

The Federal Trade Commission (FTC) and Congress, through separate actions, have collectively put pharmacy benefit managers (PBM) on notice. In June 2022, the FTC launched an investigative study into various PBM business practices. Just nine days later, the agency declared increased enforcement against any illegal rebate schemes or bribes paid to PBMs to foreclose on lower-cost drugs. Meanwhile, the Senate is debating the Pharmacy Benefit Manager Transparency Act of 2023, which would prohibit certain PBM business practices, impose new reporting requirements on PBMs, and grant the FTC broad regulatory authority over the industry.

Health plans contract with PBMs to help control drug spending via their purchasing power to negotiate lower prices and rebates. These contracts and the rebates paid to the PBM by drug manufacturers have faced heightened scrutiny from both the FTC and Congress. Consistent with FTC Chair Lina Khan’s “big is bad” approach to enforcement, Khan expressed her desire to investigate “dominant intermediaries,” and described the business model as “extractive.” Khan added that dominant intermediaries can “use [their] critical market position to hike fees, dictate terms, and protect and extend their market power.” The FTC is also concerned that “rebate practices may be driving up the list price of insulin….”

For its part, Congress continues to look for ways to reduce prescription drug prices and bring more transparency to the PBM industry. Senators Charles Grassley and Maria Cantwell, who introduced the legislation, accused PBMs of “unfair and deceptive practices that drive up the cost of prescription drugs at the expense of consumers.”

By leapfrogging the FTC study, both the FTC and Congress are acting without fully understanding whether there are, in fact, problems in the PBM industry that need to be addressed. Preemptively ramping up enforcement and passing new legislation targeting PBMs in isolation risk imposing costly and potentially unnecessary regulatory burdens on a single part of a complex prescription drug supply chain. Such policy missteps threaten to reduce competition and ultimately increase patient costs.

Pharmacy Benefit Managers

PBMs act on behalf of health plans to manage patient utilization of drugs and process prescription drug claims. More notable activities, and the subject of heightened scrutiny from Congress and the FTC, include creating insurance plan formularies, reimbursing pharmacies for prescriptions, and negotiating rebates with drug manufacturers to lower health plans’ costs. The FTC alleged that some of these “rebate schemes” could be illegally foreclosing competition and “block[ing] patients’ access to competing lower-cost drugs.” In the announcement of the 6(b) study, the FTC stated that many of these functions “depend on highly complicated, opaque contractual relationships…” and thus warrant the inquiry.

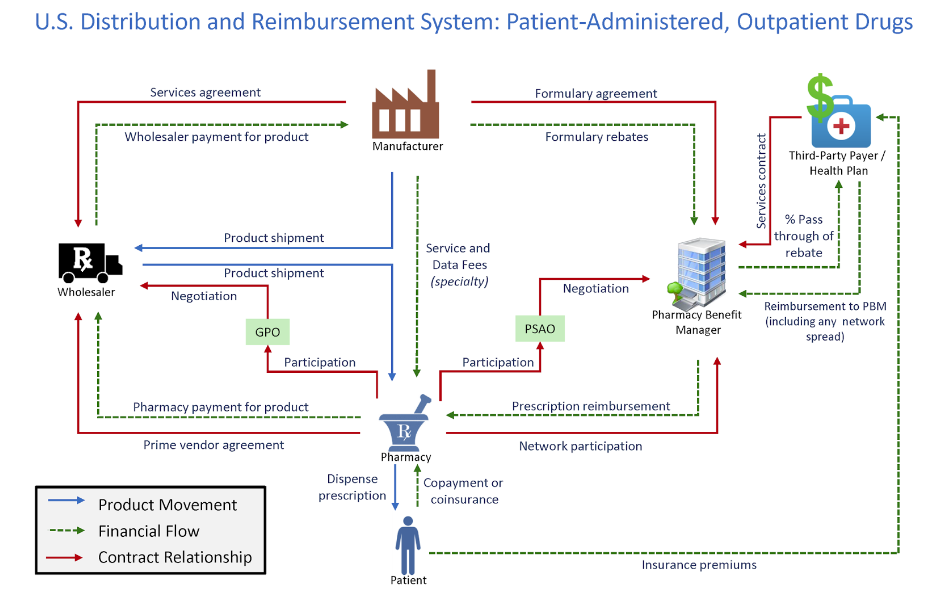

Figure 1 shows how PBMs interact with the rest of the drug supply chain. The graphic includes the product movement, financial flow, and contract relationships in the health care system.

Figure 1

*Source: Drug Channels Institute

The supply chain for pharmaceutical drugs is complex, and PBMs play an important role in lowering the costs for health plans. Research showed that the “U.S. market size [for prescription drugs] is approaching $500 billion annually, with about two-thirds of adults using them and almost 300 million people participating in prescription-drug insurance plans.” Furthermore, 95 percent of all prescriptions at retail pharmacies involve a PBM and 91 percent of drug-plan participants are served by PBMs. The research also found that the estimated net value created by PBM services is $145 billion annually. Additional research from the Government Accountability Office (GAO) specific to Medicare Part D showed that drug price rebates negotiated by PBMs “offset Part D spending by 20% from $145 billion to $116 billion.” The study also showed that PBMs negotiated $18 billion in rebates from Part D-participating manufacturers, retaining less than 1% of these rebates.

PBMs are only one part of the drug supply chain. Regulating the industry in isolation without fully accounting for its relationships and vertical integration with other participants risks higher prices and less competition.

The FTC Puts PBMs “On Notice”

The FTC announced an inquiry into the PBM industry that required the six largest firms to “provide information and records regarding their business practices.” The study was issued under Section 6(b) of the FTC Act. These studies are generally fact-finding missions conducted “without a specific law enforcement purpose,” and the FTC explained that the “inquiry is aimed at shedding light on several practices that have drawn scrutiny in recent years,” including:

- “fees and clawbacks charged to unaffiliated pharmacies;

- methods to steer patients towards pharmacy benefit manager-owned pharmacies;

- potentially unfair audits of independent pharmacies;

- complicated and opaque methods to determine pharmacy reimbursement;

- the prevalence of prior authorizations and other administrative restrictions;

- the use of specialty drug lists and surrounding specialty drug policies; and

- the impact of rebates and fees from drug manufacturers on formulary design and the costs of prescription drugs to payers and patients.”

Just nine days after the FTC announced the fact-finding mission, the agency issued a policy statement declaring a “ramp up [in] enforcement against any illegal rebate schemes, bribes to prescription drug middleman that block cheaper drugs,” and put the drug industry “on notice.” Included in the policy statement were business practices ripe for heightened scrutiny, with the topic rebates and fees overlapping with the 6(b) study. The statement made clear that the study’s findings will be used to support future enforcement action.

The FTC’s actions appear to follow the FTC’s recent “big is bad” approach to antitrust enforcement, a departure from nearly 50 years of focusing on consumer welfare.

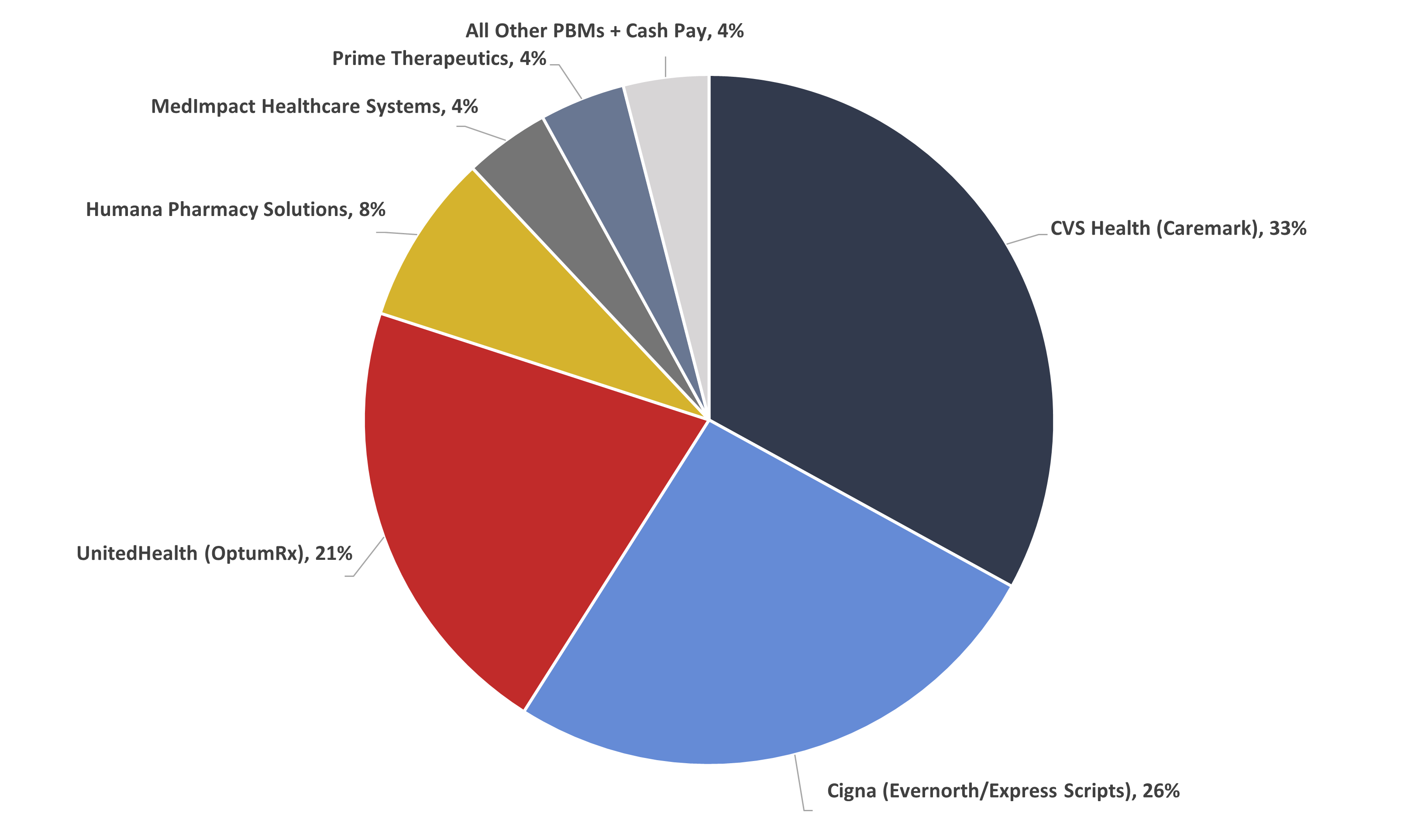

Figure 2 shows that the three largest PBMs controlled 80 percent of the market in 2021.

Figure 2

PBM Market Share, By Total Equivalent Prescription Claims Managed, 2021

*Source data: Drug Channels Institute

Pharmacy Benefit Manager Transparency Act of 2023

Some members of the Senate concur with the FTC that PBMs contribute to the rising cost of prescription drugs. But rather than waiting for the conclusions of the FTC study to assist in crafting the legislation, Senators Maria Cantwell and Charles Grassley introduced the Pharmacy Benefit Manager Transparency Act of 2023.

The proposed legislation would strap the industry with additional compliance costs. Each year, PBMs would be required to report information to the FTC regarding changes to formularies, reimbursement rates, and clawbacks. Much of these increased costs would likely be passed on down the supply chain, ultimately being paid for by patients. PBMs unable to pass along or absorb these increased compliance costs would be forced out the market, resulting in fewer competitors.

The legislation also directs the GAO to conduct a study addressing rebates, fees, and other sensitive business information with the goal of more industry transparency. The GAO will be required to provide Congress with a report that includes company-level data of the amount of the rebates passed on to patients and payors, the amount of the rebate kept by the PBM, and how PBMs structure their formularies. But the competitiveness of the PBM industry relies on negotiating. And the ability to negotiate relies on confidentiality. Such a requirement would compromise an individual PBMs ability to negotiate with pharmacies and drug manufacturers and could result in higher prices.

Conclusion

Even before the FTC’s investigation into the business practices of PBMs has concluded, the agency quickly declared that the industry requires increased oversight and enforcement. Congress, too, may be jumping the gun in its conviction that PBMs represent a malign influence in the prescription drug market, with the Senate now debating legislation that would prohibit certain PBM activity and grant the FTC increased regulatory power.

The FTC and the Senate have, as planned, put the PBM industry “on notice.” Yet by prejudging the exact nature of PMB influence in the prescription drug market, lawmakers and regulators, according to available data, risk hindering competition and ultimately raising patient costs.