Week in Regulation

October 3, 2022

Beneficial Ownership Rule Ends September with a Bang

The final week of September was a notable one both in terms of the volume of regulatory activity and the magnitude of the actions involved. There were 15 rulemakings with some measurable economic impact. This regulatory haul included some significant measures from the Food and Drug Administration (FDA), but an ownership reporting rule from the Financial Crimes Enforcement Network (FinCEN) was clearly the main issue of the week. That rule alone propelled 2022’s final rule cost total past the $100 billion threshold. Across all rulemakings, agencies published $80.6 billion in total net costs and added 53.8 million annual paperwork burden hours.

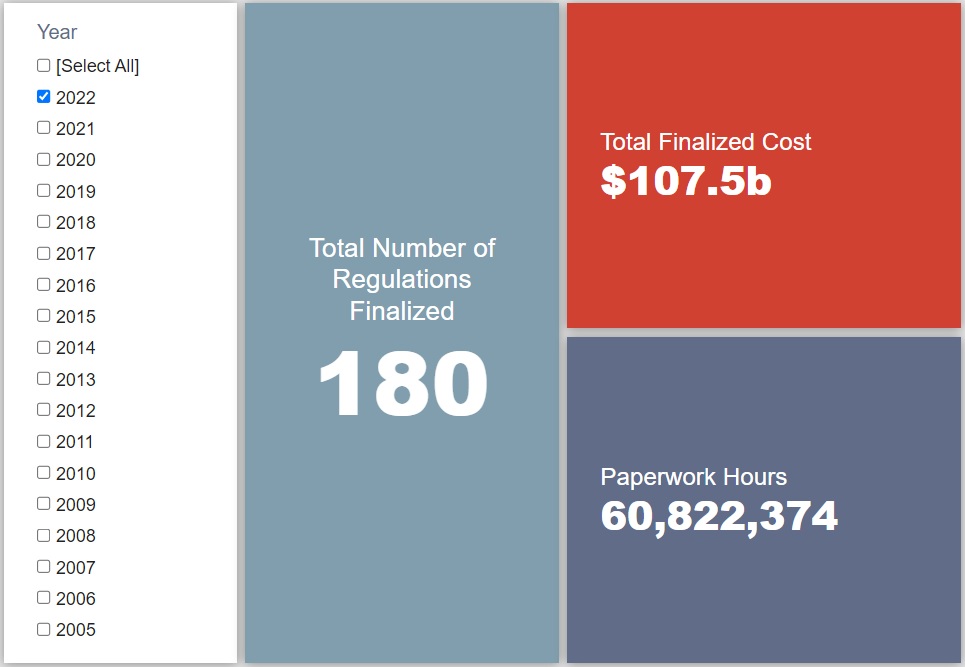

REGULATORY TOPLINES

- Proposed Rules: 30

- Final Rules: 61

- 2022 Total Pages: 59,533

- 2022 Final Rule Costs: $107.5 billion

- 2022 Proposed Rule Costs: $124.3 billion

NOTABLE REGULATORY ACTIONS

The far and away most consequential rulemaking of the week was FinCEN’s rule regarding “Beneficial Ownership Information Reporting Requirements.” The rule, originally proposed in December 2021, establishes a reporting framework that seeks to require “certain entities to file with FinCEN reports that identify two categories of individuals: the beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to do business.” FinCEN is finalizing the rule “largely as proposed,” but – perhaps due to considerations raised in the comment period – its estimated economic impact has increased significantly. The agency now estimates that the rule will impose $84.1 billion in total costs with more than 53 million hours of paperwork each year. These massive totals come from the rule’s incredibly broad impact: More than 32 million companies will have to file the required reports initially and FinCEN expects millions more to be affected in the coming years.

But for this FinCEN rule, FDA would have been the star agency of the week. First, its pair of proposed rules seeking to harmonize and streamline “institutional review board” standards would yield a combined total of nearly $3.7 billion in net savings. On the other hand, however, FDA also had a proposal regarding “Food Labeling: Nutrient Content Claims; Definition of Term ‘Healthy.’” The rulemaking comes as a key part of the Biden Administration’s National Strategy on Hunger, Nutrition, and Health and would “update the definition for the implied nutrient content claim ‘healthy’ to be consistent with current nutrition science and Federal dietary guidance.” FDA estimates that requiring food producers to change their current labels to comply with these new guidelines will involve $237 million in total costs.

TRACKING THE ADMINISTRATIONS

As we have already seen from executive orders and memos, the Biden Administration will surely provide plenty of contrasts with the Trump Administration on the regulatory front. And while there is a general expectation that the current administration will seek to broadly restore Obama-esque regulatory actions, there will also be areas where it charts its own course. Since the AAF RegRodeo data extend back to 2005, it is possible to provide weekly updates on how the top-level trends of President Biden’s regulatory record track with those of his two most recent predecessors. The following table provides the cumulative totals of final rules containing some quantified economic impact from each administration through this point in their respective terms.

The Beneficial Ownership rule discussed above was clearly the main reason for dramatic surges in the Biden Administration’s cost and paperwork totals. His administration now outpaces even the Obama Administration by more than $100 billion in costs and 100 million hours of paperwork. Meanwhile, on the opposite side of the ledger, the Trump Administration’s costs and paperwork totals decreased further by $2.6 billion and 81,000 hours, respectively. A deregulatory measure from the Department of the Interior rescinding an Obama-era rule concerning natural gas wells was the primary driver of that trend.

Quarterly Update

In order to better illustrate these general trends over time, AAF will provide a look at where each of the covered administrations stands at the end of each quarter in terms of regulatory costs. The graph below provides the first installment of this series. As one can see, after relative parity in the earlier part of each administration’s first year, the Biden Administration cost tally shot up dramatically. While the Obama Administration seemed to be closing the gap as of a few months ago, the current administration has since widened its lead (again, due in no small part to this week’s Beneficial Ownership rule). By way of contrast, the Trump Administration now lands in the negative costs zone. The pace of that trend, however, has clearly been much more gradual than the cost spikes brought by its two counterparts.

THIS WEEK’S REGULATORY PICTURE

This week, the Consumer Financial Protection Bureau (CFPB) digs up its regulatory sandbox and scraps compliance assistance tools.

On September 27, the CFPB published a rule in the Federal Register titled “Statement on Competition and Innovation.” The rule jettisons two policies put in place during the Trump Administration designed to provide companies with regulatory flexibility and pathways to innovation.

The first policy concerns “No-Action Letters” through which the agency would grant assurances in certain circumstances that it would not bring a supervisory or enforcement action against companies. The process involved a company submitting an application for a No-Action Letter explaining why it believed relief from certain regulations would help in the creation of new products and services. As an example, the CFPB granted a letter to a company in 2020 to allow for the use of artificial intelligence for pricing and underwriting loans for a period of three years in case the process ran afoul of particular regulations.

The second policy, known as the Compliance Assistance Sandbox, created a process for “how the CFPB would grant a company immunity from liability under one or more of three safe harbor provisions and provide an approval concluding that the offering or providing of certain aspects of an individual company’s product or service complies with the relevant Federal consumer financial law.”

Combined, the policies offered companies a means to experiment with innovative products and services that could have potentially resulted in unforeseen violations of CFPB rules. Alas, the CFPB’s new leadership decided to abandon the policies to “preserve resources and reduce (administrative) inefficiency and burden.”

The agency chose a unique method to ditch the policies. Rather than withdrawing them outright, the CFPB allowed the Paperwork Reduction Act (PRA) approvals for the application processes to expire on September 30. Since federal information collections need to be approved, the agency technically cannot accept new applications for No-Action Letters or the Compliance Assistance Sandbox. The agency decided to use this occasion as a means to withdraw the policies.

TOTAL BURDENS

Since January 1, the federal government has published $231.8 billion in total net costs (with $107.5 billion in new costs from finalized rules) and 135.5 million hours of net annual paperwork burden increases (with 60.8 million hours in increases from final rules).