Week in Regulation

December 13, 2021

Pair of Proposed Rules Dominate the Week

In terms of the volume of meaningful regulatory activity, last week would usually be categorized as a busy one with 14 rulemakings carrying some measurable economic impact. Most of these actions, however, had relatively minimal impacts with most topping out in the low millions of dollars range. Yet there were two proposed rules that brought the fireworks. Across all rulemakings, agencies published $7.4 billion in total net costs and added 17.8 million annual paperwork burden hours.

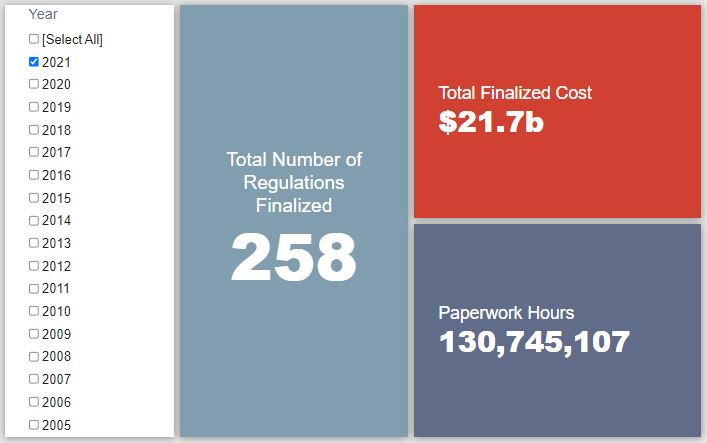

REGULATORY TOPLINES

- Proposed Rules: 49

- Final Rules: 77

- 2021 Total Pages: 70,577

- 2021 Final Rule Costs: $21.7 billion

- 2021 Proposed Rule Costs: $199.7 billion

NOTABLE REGULATORY ACTIONS

Of the two main proposed rules published last week, the more significant one was the Biden Administration’s latest volley in the ongoing regulatory saga regarding the “Waters of the United States” (WOTUS). A joint rulemaking between the Environmental Protection Agency and the Army Corps of Engineers (the agencies), this latest entry on the topic seeks to largely restore a WOTUS regulatory framework established under the Obama Administration. The American Action Forum (AAF) has a breakdown of its details here. In the agencies’ economic analysis, they find that – vis-à-vis the WOTUS standard set under the Trump Administration – it would cost affected entities between $113-$276 million annually. On average, that comes out to $194.5 million annually, or nearly $3.9 billion over a 20-year period.

The other notable rulemaking of the week was a proposed rule from the Department of Treasury (Treasury) regarding “Beneficial Ownership Information Reporting Requirements.” The proposal seeks to “implement Section 6403 of the Corporate Transparency Act (CTA),” in order to acquire information on potential shell companies that may be involved in “money laundering, terrorist financing, tax fraud, and other illicit activity.” AAF has a further analysis of the rulemaking’s potential implications here. In terms of direct economic impact, however, the breadth of entities covered by these new requirements produces sizable administrative burdens. Treasury’s preliminary analysis suggests that the proposal could bring 17.3 million hours of new paperwork each year, leading to roughly $3.4 billion in total costs over a 10-year period.

TRACKING THE ADMINISTRATIONS

As we have already seen from executive orders and memos, the Biden Administration will surely provide plenty of contrasts with the Trump Administration on the regulatory front. And while there is a general expectation that the new administration will seek to broadly restore Obama-esque regulatory actions, there will also be areas where it charts its own course. Since the AAF RegRodeo data extend back to 2005, it is possible to provide weekly updates on how the top-level trends of President Biden’s regulatory record track with those of his two most recent predecessors. The following table provides the cumulative totals of final rules containing some quantified economic impact from each administration through this point in their respective terms.

![]()

Given that the major Biden Administration actions of the past week were proposed rules, they do not count toward the administration’s final rule tallies. Thus, the Biden Administration’s totals saw minimal change. The Trump Administration also saw minimal shifts in its regulatory top-lines through the first third of December 2017. The only real mover and shaker of the three administrations was the Obama era. Early December 2009 saw a nearly $2.9 billion uptick in regulatory costs, due almost entirely to a pipeline safety rule with roughly $2.8 billion in total costs.

THIS WEEK’S REGULATORY PICTURE

This week, the Senate voted to repeal the Occupational Safety and Health Administration’s (OSHA) vaccine and testing requirement for large companies.

On December 8, the Senate passed a resolution of disapproval to nullify OSHA’s interim final rule, COVID-19 Vaccination and Testing; Emergency Temporary Standard (ETS). The resolution was the eighth Congressional Review Act (CRA) measure introduced in 117th Congress and the fourth to clear the Senate.

The CRA allows Congress to strike down regulations issued by federal agencies. If a resolution of disapproval pertaining to a rule is passed by both chambers of Congress and signed by the president, the rule becomes void and the agency that issued the rule cannot issue a rule in “substantially the same form” in the future.

Congressional opposition to the rule has come primarily from Republicans, who have viewed the requirement that employers with 100 or more employees either require employees to be vaccinated against COVID-19 or develop a plan to regularly test employees as a federal overreach. Federal courts appear to have agreed – the rule is currently stayed pending the outcome of lawsuits seeking to overturn it.

Republican senators were able to get two Democratic senators, Joe Manchin and Jon Tester, to join their side for the vote, which pushed the tally to 52-48 in favor of passage.

Any further action now depends on the House of Representatives, which is very unlikely to ever vote on the measure due to its slim Democratic majority. If the House did pass the resolution, however, the rule would still not be nullified. The White House signaled this week that it would veto the resolution, and there are not enough votes in either the House or Senate to override the veto.

As a result, this week’s Senate vote can best be viewed as a political statement against federal overreach.

TOTAL BURDENS

Since January 1, the federal government has published $221.4 billion in total net costs (with $21.7 billion in new costs from finalized rules) and 156.6 million hours of net annual paperwork burden increases (with 130.7 million hours in increases from final rules).