Insight

November 1, 2017

2018 Premium Increases and a Legacy of Uncertainty

On October 30, the Department of Health and Human Services (HHS) released preliminary data on health insurance premiums for the plans that will be offered through the federal exchanges for the 2018 plan year. While the results are unsurprising, they are discouraging.[1]

Most notably, average monthly premiums for the second-lowest cost silver plan (also known as the benchmark plan) by rating area will increase by 37 percent for 2018—the second year in a row that benchmarks have increased by an average of 20 percent or more. Of the 39 states included in the data, 11 states will see benchmark premium increases of 50 percent or more. This is expected to increase the average monthly benchmark premium for a 27-year-old, for example, to more than $400. Meanwhile, the average lowest cost plan within each rating area is expected to increase by 17 percent in 2018. Competition in the marketplace will also continue to decrease as 29 percent of the population in federal exchanges will only have one insurer to choose from, up from 20 percent with a single choice of insurer in 2017. The stability of the exchange market created by the Affordable Care Act (ACA) is precarious. However, while the significant and obvious flaws with the policies (or lack thereof) currently governing the exchanges take center stage, it must not be forgotten that this is the latest in a long line of troubles for the ACA exchanges.

The History of ACA Exchange Premium Increases

Since its inception, the ACA Marketplace has been plagued by uncertainty and instability. Generally speaking, disruption of any marketplace creates this uncertainty along with increased costs. Upon the introduction of the ACA, premiums in the individual market were estimated to have increased by 50 percent on average nationwide from 2013 to 2014.[2] In 2015 and 2016, average benchmark premium increases were more modest as the risk pools began to grow.

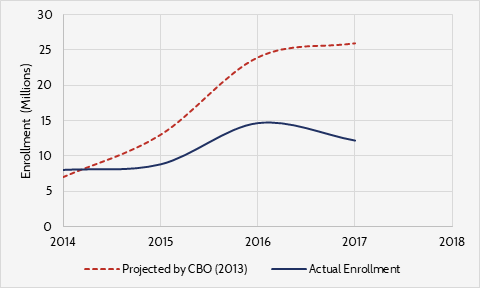

Figure 1. ACA Exchange Enrollment (Projected vs Actual)[3]

However, there were signs that the exchanges were not maturing as planned. The individual mandate did not push as many young people into the exchanges as expected or needed. Further, exchange plans were changing from year to year, providers were declining to participate, and by 2016 insurers were beginning to drop out. The ACA co-ops, which were federally subsidized insurance start-ups intended to facilitate competition, began to collapse at the same time. By 2016, it was clear that enrollment had stalled as only 14 million people signed up for insurance through the exchange—about 9 million less than was expected in 2014.[4],[5] This environment led to a 24-percent average premium increase in benchmark plans in 2017, as insurers struggled to accurately rate a risk pool that looked nothing like the one they had been expecting.[6]

Why the Increase for 2018?

ACA Marketplace uncertainty is the blight that led to increased premiums in previous years, and it will lead to even greater increases for the 2018 plan year. Setting premiums for a plan year is a five-month process that begins in May of the previous year. But throughout the entire 2018 rate-setting process, it was unclear that insurers would receive cost sharing-reduction (CSR) payments during the 2018 plan year. CSRs are payments made to insurers to compensate them for limiting out-of-pocket expenses (co-pays, coinsurance, deductibles) for low-income purchasers of silver policies (but not bronze, gold or platinum plans) in the ACA exchanges. Without CSRs, insurers that participate in the exchanges would sustain losses whenever an eligible beneficiary incurred claims, and the only way that insurers can cover these losses is through increased premiums. Accordingly, most insurers set premiums for 2018 as if CSRs would not be available, hence the large increases.

The Immediate Effects of Premium Increases

Most who purchase insurance through the exchanges will experience negligible effects. In 2017, 85 percent of consumers who purchased health insurance through the federally facilitated exchanges were eligible for Advanced Premium Tax Credits (APTCs).[7] For those who receive APTCs, the amount of income they can spend on premiums is capped at a certain percentage. Once an eligible consumer spends a certain amount on premiums, the credit kicks in and covers the rest. Therefore, consumers eligible for APTCs will likely not see an increase in out-of-pocket spending on premiums.

The increase in premiums will be felt most by the 15 percent of the exchange population that is not eligible for APTCs. Consumers in this population may seek to mitigate immediate out-of-pocket costs by opting for a less comprehensive plan, or decide to forego insurance altogether.

In addition to the impact on individual consumers, increased premiums, especially for the benchmark plans, have major implications for the federal budget. Taking the Congressional Budget Office’s (CBO) estimations of monthly enrollment for 2017 and 2018, and that 85 percent of the exchange population is eligible to receive APTCs along with an average monthly credit of $555 in 2018, federal spending on APTCs could increase by roughly $15 billion. The CBO determined that terminating funding for CSRs would increase the federal deficit; this rough calculation supports that finding.

Table 1. Federal APTC Spending

|

2017 |

2018 |

|

| Estimated Monthly Enrollment (millions)[8] |

10 |

11 |

| Average Annual APTC |

$4,584 |

$6,660 |

| Estimated Federal APTC Spending (billions) |

47.5 |

62.3 |

Conclusion

The large premium increases set for 2018 are a continuation of the problems that have plagued ACA Marketplace since its inception, and that have been exacerbated by the uncertainty of the last year. It is important to remember, however, that the 2018 premium increases are far from the only problem. Even with CSR payments and a new administration, the ACA exchanges have myriad, serious problems that must soon be addressed. The need for practical reform is even more real and urgent today than it was a year ago.

[1] https://aspe.hhs.gov/system/files/pdf/258456/Landscape_Master2018_1.pdf

[2] Manhattan Institute, “The Obamacare Impact,” available at: http://www.manhattan-institute.org/knowyourrates/

[3] Actual enrollment numbers acquired at: https://aspe.hhs.gov/historical-research

[4] https://www.cbo.gov/sites/default/files/recurringdata/51298-2013-02-aca.pdf

[5] https://aspe.hhs.gov/health-insurance-marketplaces-2016-open-enrollment-period-final-enrollment-report

[6] https://www.cbo.gov/sites/default/files/recurringdata/51298-2015-03-aca.pdf

[7] https://aspe.hhs.gov/health-plan-choice-and-premiums-2017-health-insurance-marketplace

[8] Monthly enrollment projections taken from CBO’s 2017 Baseline: https://www.cbo.gov/sites/default/files/recurringdata/51298-2017-01-healthinsurance.pdf