Week in Regulation

March 31, 2025

The Current Trump Administration’s Largest Deregulatory Action So Far

In what has become a bit of a pattern, the past week in regulation was a sparse yet punchy one. Just one week after the proposal of the costliest rulemaking thus far in this second Trump term, last week saw the administration post its most substantial cost-cutting rule to date. The measure out of the Financial Crimes Enforcement Network (FinCEN) dramatically narrows the scope of the “Beneficial Ownership” rule promulgated under the Corporate Transparency Act. Across all rulemakings, agencies published $83.9 billion in total cost savings and cut 53.2 million paperwork burden hours.

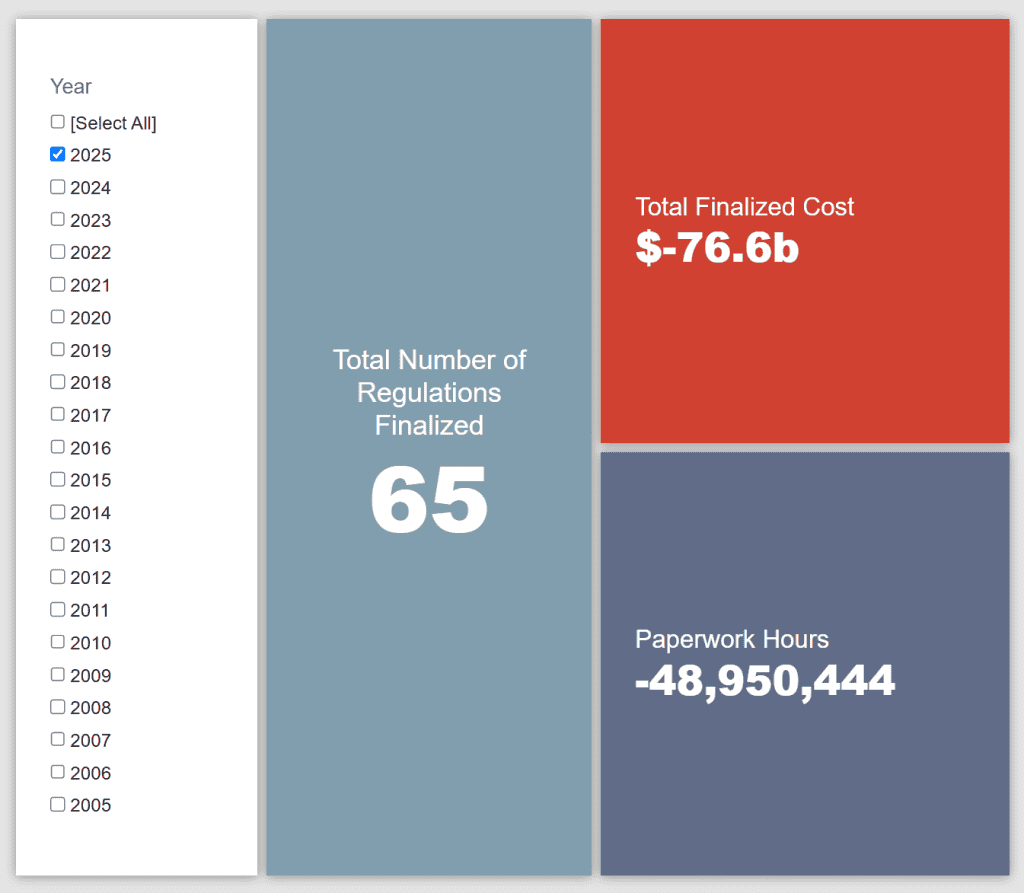

REGULATORY TOPLINES

- Proposed Rules: 24

- Final Rules: 33

- 2025 Total Pages: 14,163

- 2025 Final Rule Costs: -$76.6 billion

- 2025 Proposed Rule Costs: $181.3 billion

NOTABLE REGULATORY ACTIONS

The most consequential action of the week was clearly the interim final rule from FinCEN regarding “Beneficial Ownership Information Reporting Requirement Revision and Deadline Extension.” The rulemaking – telegraphed by the agency earlier this month – significantly pares back the scope of the original 2022 rule by applying it only to foreign entities rather than the millions of potentially affected domestic entities. FinCEN cites timing-based concerns as its rationale for promulgating this change via an interim final rule (IFR) rather than a novel rulemaking.

The impact of such a change is sizable but does require teasing out due to some curious aspects of information provided in the rule’s analysis sections. In what is almost assuredly a typographical error, the rule at one point lists “32,3802 [sic] hours per year” in an instance where it appears the figure should be 32,380. Also, the IFR claims roughly 91.5 million hours of annual paperwork cuts, which is difficult to square with the fact that the original rule had a grand total of 53.3 million hours. Additionally, the IFR cost analysis section seems to forgo the growth impacts included in 2022 rule’s cost estimates.

In any case, for the purposes of illustrating the IFR’s total impact, the clear implication of the IFR is the narrowing of the rule’s scope. Furthermore, the rule’s cost derives exclusively from the administrative burdens of its reporting requirements. As such, to arrive at a comparable number, it is a matter of determining the scale of this narrowing. The IFR now has a paperwork total of roughly 84,000 hours annually. This represents less than 0.2 percent of the paperwork total from the original rule. As such, one can assume that 99.8 percent of the rule’s costs now constitute “savings,” which – when applied to the estimate recorded from the 2022 rule – would mean total savings of just under $84 billion.

TRACKING TRUMP 2.0

This past week saw the following Congressional Review Act (CRA) resolutions pass through at least one chamber of Congress:

HOUSE

- J. Res 24 (Passed 203-182)

- J. Res 75 (Passed 214-193)

SENATE

- J. Res 18 (Passed 52-48)

- J. Res 25 (Passed 70-28)

Out of the above bunch of resolutions, H.J. Res 25 – which seeks to repeal an Internal Revenue Service rule – is the one that now heads to the White House for President Trump’s expected signature. As noted here a couple of weeks ago, this particular CRA resolution has taken a bit of a winding road despite the rather robust cross-partisan majorities for it in both chambers.

Be sure to follow the American Action Forum’s (AAF) updated CRA tracker. As of today, members of the 119th Congress have introduced CRA resolutions of disapproval addressing 40 Biden-era rules that collectively involve $137.5 billion in compliance costs. AAF will continue to update this tracker as additional resolutions are introduced and receive votes on the floors of each chamber.

TOTAL BURDENS

Since January 1, the federal government has published $104.8 billion in total net costs (with $76.6 billion in cost savings from finalized rules) and 69.4 million hours of net annual paperwork cuts. (with 49 million hours coming from final rules).