Insight

June 28, 2019

What Congress Needs to Consider When Reforming Medicare Part D

The projected OOP costs included in this post, originally published on June 28, 2019, were corrected and updated on September 17, 2019, to account for the proposal included in the Senate Finance Committee’s Prescription Drug Pricing Reduction Act of 2019, considered by the Committee on July 25, 2019.

Executive Summary

AAF’s proposal to reform the Medicare Part D program has gained attention recently, but with this attention have come both questions and suggestions for how the proposal could be modified. This paper discusses some of those ideas and provides further analysis to better inform the conversation.

- In setting an out-of-pocket (OOP) cap, the primary trade-off to consider is how many beneficiaries should receive financial protection versus how much premiums should be increased: the lower the OOP cap, the higher the premiums.

- Requiring drug manufacturers to pay rebates in coverage phases beyond just the catastrophic phase will more evenly spread the burden across manufacturers and drug classes, but may weaken the incentive not to increase prices, relative to AAF’s original proposal, depending on the discount rates required. It may also provide financial savings to more beneficiaries.

- Implementing this proposal in combination with the administration’s proposed “rebate rule” could lead to even higher premium increases. Further, a lower OOP cap would be required to keep the overall spending that occurs before catastrophic coverage at roughly the same level, which in turn would keep expected manufacturer rebates roughly equal.

Potential Modifications to AAF’s Proposal

AAF’s proposal seeks to address a couple of problems in the current structure of Medicare Part D. Because insurer liability is very limited in the catastrophic phase, insurers have little incentive to keep beneficiaries out of that final phase. Further, drug manufacturers have no real incentive to keep their prices down. The result of this lack of incentives is that the government is paying more of Part D’s cost in the catastrophic phase, and the government’s overall costs are rising. Finally, the current structure leaves some beneficiaries with very high costs even in the catastrophic phase.

AAF’s proposal addresses these problems by making several changes: It increases insurer liability in the catastrophic phase, moves the required manufacturer rebates to the catastrophic phase, and places a cap on beneficiaries’ out-of-pocket (OOP) liability. There are several provisions of the proposal which could be modified—to a degree—without substantially undermining the intent of the original proposal. Such modifications include adjusting the OOP cap, adjusting the share of liability held by each of the stakeholders in the catastrophic phase, and potentially requiring manufacturers to pay discounts both before and after the catastrophic phase.

Options for the OOP Cap and How to Index It

Determining where to set the OOP limit is primarily a question of balancing how many beneficiaries should be protected from high OOP costs (and the level of protection that should be provided) against the need for premiums not to increase dramatically, as premiums will rise as the OOP limit drops, all else being equal. The analysis done by Milliman in July 2018 modelling OOP maximums between $2,500 and $4,000 illustrates this dynamic. At $4,000, the cost of the premium increase is expected to be $60.9 billion less over 10 years relative to what it would be under a $2,500 OOP cap.

For comparison, under the current system beneficiaries reaching the catastrophic coverage phase in 2020 will spend an estimated $2,650 in OOP costs before reaching that phase. As a result, setting the cap at $2,500 provides a comparable threshold to the current system while also providing financial relief to all beneficiaries reaching catastrophic coverage (as well as some who are currently just below the threshold). While premiums are still expected to rise with a $2,500 cap, insurers know the importance of premiums to beneficiaries when selecting a plan and will likely try to mitigate increases through various means, including increased utilization management tools.

Some are also interested in providing a monthly OOP cap to assist beneficiaries—particularly those individuals on a fixed income—facing a very high OOP cost in a single month, potentially reaching the annual OOP cap by January or February. There are two different ways a monthly OOP cap may be applied, and they would have different impacts. Both methods have the potential for gaming the system, though, which would consequently increase insurer liability. As a result, if monthly OOP caps were also required, premiums would likely increase to some degree beyond what is expected from simply imposing an annual OOP cap to account for this uncertainty.

A cap that limits OOP expenses in a given month, such that once the cap is reached the beneficiary will not then nor in the future be responsible for any more costs incurred that month, could lead to some manipulating the system. For example, a beneficiary, upon learning that he will reach the monthly limit, may try to fill all other medications he is prescribed or multiple doses of a medicine before the month’s end.

Alternatively, a monthly cap could be imposed that limits OOP spending for a single month but allows any amount over the monthly cap to still be due in following months, similar to an installment payment plan. For example, if a beneficiary has an OOP liability of $2,000 one month, but a $500 monthly cap is imposed, the beneficiary would pay the $2,000 over the course of four months. This method may be less likely to lead to abuses and lessen the possibility that significant unexpected additional liabilities will fall to the insurer, which in turn should help keep premiums from rising. Gaming this structure would still be possible, though, depending on how the policy deals with a large expense that falls in the final months of the year. To apply the example from above, if the $2,000 OOP liability occurred in November, would the beneficiary only have to pay $1,000? If the answer is yes, then beneficiaries may try to delay treatment regimens until the end of the year.

An OOP cap, whether annual or monthly, could be indexed just as the various coverage phase limits are currently: increasing at the average rate of per capita cost growth in the program.

Share of Catastrophic Liability Held by Insurers, Manufacturers, and the Government

One feature of AAF’s proposal that has gained significant attention is that it sets the manufacturer’s liability in the catastrophic phase at 9 percent. The proposal simply did not intend to take a position on how much responsibility for the program’s total costs each of the stakeholders should take, instead respecting the liabilities that Congress has required to date. Thus, 9 percent was found to be the percentage that would be budget-neutral for the pharmaceutical industry as a whole over the 10-year period considered, relative to current projections, based on Milliman’s model prior to any assumed behavioral changes. That said, AAF’s proposal assumes that rearranging the liabilities and applying them in the manner suggested more appropriately aligns incentives and more effectively works to contain program costs.

Of course, the intent of the proposal is to change behavior; specifically, it seeks to reduce the prices paid for drugs. Accordingly, modeling showed the expected impact of AAF’s proposal if it induced a 5 percent reduction in spending on non-specialty brand-name drugs, achieved through a combination of price reductions and increased plan management of high-cost drugs. Analysis by Milliman found that such a change would reduce the rebates drug manufacturers pay, relative to the baseline scenario, by $1.6 billion over 10 years.[1] It is important to note, however, that a reduction in rebates owed does not necessarily translate to higher revenue for drug companies: Again, those projected reductions in rebates are based on an assumption that prices and spending on drugs is reduced. In other words, drug manufacturers would only owe less in rebates if overall program spending is reduced, essentially allowing them to share in the savings.

The proposal’s distribution of liability for plans and the government was largely modeled on the 2016 recommendation from MedPAC. It seemed appropriate to maintain a minimum level of government reinsurance of 20 percent, and thus the manufacturer liability was deducted from the share for which the insurers otherwise would have been responsible. In April, MedPAC illustrated the trade-offs between increasing or decreasing the level of liability held by the plans and manufacturers.[2] Any change in liability for each of the stakeholders will of course have various mathematical and behavioral impacts.

Requiring Manufacturer Discounts in the Coverage Gap and Catastrophic Phase

Some have suggested that manufacturers should continue paying rebates in the coverage gap in addition to paying rebates in the catastrophic coverage phase. The impacts of such a change to the proposal would depend on the rebate amounts required. In order to maintain budget neutrality for the pharmaceutical industry, as AAF’s original proposal does, it would necessarily require a lower rebate percentage than 9, likely 5-6 percent, assuming a flat rate in both phases of coverage. Doing so would certainly spread the risk more evenly across the pharmaceutical industry but could also lessen the financial incentive not to increase prices, relative to what a higher percentage in the catastrophic phase would encourage.

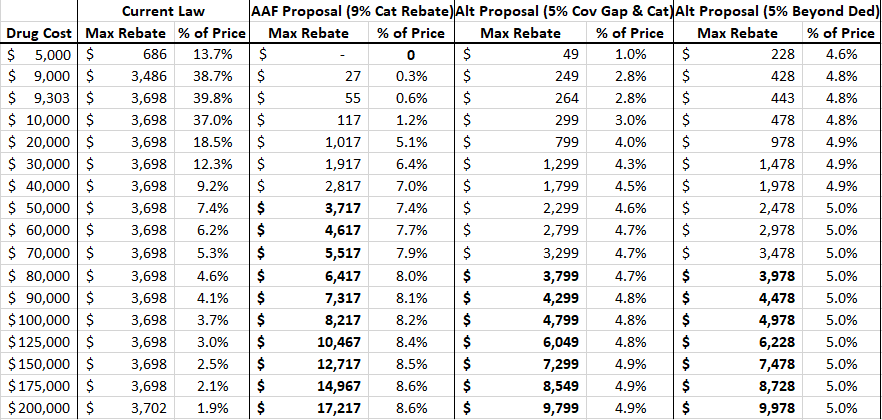

As shown in the second and third columns of the table below, the current Coverage Gap Discount Program (CGDP) becomes less impactful as the price of the drug increases because the rebate amount is indirectly capped. For example, a drug costing $9,303—the lowest price at which the maximum rebate amount will be required, as explained here—pays a rebate equal to 39.8 percent of the cost of the drug. A drug priced at $60,000, on the other hand, pays the same rebate amount, but that amount is equal to only 6.2 percent of the drug’s price. Thus, the current benefit design is more harmful to lower-priced drugs. Requiring the rebate in the catastrophic phase of coverage such that it is no longer capped allows the required rebate amount to increase, both nominally and as a share of the drug’s price, as the price increases, targeting more of the burden on the higher-priced drugs. The fourth and fifth columns track the required rebates under AAF’s proposal for drugs of different prices.

Table 1: Rebates Required Under Various Reform Proposals

The last four columns of the table show the rebate amounts under two variations of the AAF proposal: for the sixth and seventh columns, if rebates were required to be paid in both the coverage gap and catastrophic coverage phases (in other words, a flat percentage for the total cost of the drug in excess of the initial coverage limit, which will be $4,020 in 2020); and in the eighth and ninth columns, a policy that would require a rebate for any spending above the deductible. As the bolded numbers indicate, the “break-even price” (at which point the rebate amount required under these proposals is equal to the rebate amount required under current law) would be significantly higher than the break-even price for AAF’s original proposal. Requiring a 5 percent rebate in both the coverage gap and catastrophic phase would not yield a rebate equal to or greater than $3,698 until the price of the drug reaches $77,980. If a 5 percent rebate were required for all spending above the deductible, the break-even price would be $74,395. Prior analysis showed the break-even price under AAF’s original proposal is $49,784.

Regarding the overall impact, there were 565 drugs for which average spending per beneficiary in 2017 exceeded $4,020 (the initial coverage limit, or ICL, for a standard benefit plan in 2020), according to the Centers for Medicare & Medicaid Services’ Drug Spending Dashboard. These drugs were provided to 3.7 million beneficiaries for a total cost (including spending before the ICL) of $61.1 billion. To estimate the potential impact of the policy being considered here, assume spending per beneficiary for all drugs increases 5 percent from 2017-2020 and utilization for all drugs increases 10 percent (the rate that overall enrollment is expected to increase over this period). Based on these assumptions, it is estimated that 582 drugs will have an average cost per beneficiary exceeding the ICL of $4,020 in 2020 and will be provided to 4.2 million beneficiaries at a total cost of $71.3 billion. Spending above the ICL for these drugs will equal an estimated $54.3 billion. If a 5 percent rebate were required from drug manufacturers for all spending in the coverage gap and catastrophic phase, $2.7 billion in rebates would be collected on these drugs alone. A 6 percent rebate would provide $3.3 billion in rebates. Each percentage point increase in rebates required would provide an additional $543.3 million in rebates. Of course, rebates will also be paid for drugs costing less than $4,020 if they happen to be prescribed after the beneficiary has incurred total costs exceeding that amount, but it is difficult to estimate that impact.

If a rebate were required for any spending that occurred above the deductible, significantly more drugs would be affected. Using the same assumptions from the previous analysis, 1,657 drugs will be provided to 46 million beneficiaries with average spending per beneficiary exceeding $435 (the deductible for a standard benefit plan in 2020). Total spending on these drugs, based on the aforementioned assumptions, would equal $144.9 billion with $124.8 billion occurring after the deductible has been reached for each of these beneficiaries, assuming they are taking no other drugs. Requiring a 5 percent rebate for all spending beyond the deductible would yield $6.2 billion in rebates in 2020 from these drugs. While it remains true that this total is likely not the entirety of rebates that would be collected, this does capture a much greater share of overall rebates that would be collected because spending on these drugs accounts for 82 percent of overall program spending, under these assumptions.

If pharmaceutical discounts are required in any phase beyond the deductible where the beneficiary would otherwise be expected to cover a portion of the costs, the share of costs covered by the drug manufacturers could be used to reduce beneficiary cost-sharing in that phase. Doing so would allow manufacturer and insurer liability to remain constant through each of the benefit phases while providing beneficiaries additional relief. This additional relief would, most notably, benefit patients with lower annual spending who would not benefit from the imposition of an OOP cap, as shown below. Alternatively, the manufacturer discounts could be used to reduce plan liability, which could help offset expected premium increases, reducing costs for beneficiaries and the direct subsidy paid by the government.

Impact on Beneficiaries with Various Total Drug Costs

The following table shows the various OOP requirements that would be required of beneficiaries under various proposals at various total drug costs. The third column shows the OOP liability under the original AAF proposal, given various total annual drug costs. Beneficiaries would pay their deductible plus 25 percent cost-sharing until reaching the $2,500 OOP cap. The fourth column shows the OOP liability for the same total costs under a proposal to require manufacturers to pay 5 percent of costs incurred after the beneficiary reaches the deductible, reducing beneficiary OOP liability to 20 percent of costs above the deductible until the $2,500 OOP cap is reached. The last column shows the OOP liability under the Senate Finance Committee proposal to provide a $3,100 OOP cap and require manufacturer rebates of 20 percent. As you can see, any beneficiary with total drug spending above $8,695 will benefit from either of the first two proposals. The second proposal will benefit patients with much lower costs. The Senate Finance proposal, on the other hand, would not reduce beneficiaries’ OOP liability, relative to current law, until total drug spending surpassed $18,000; however, under the Finance proposal, beneficiaries would reach the catastrophic phase with $3,100 in OOP expenditures after $11,095 in total drug costs. (OOP costs accumulate faster under the Finance proposal because beneficiaries no longer benefit from manufacturer discounts counting toward TrOOP and thus stay below the catastrophic threshold, paying 25 percent coinsurance rather than 5 percent, longer.)

Table 2: Out-of-Pocket Requirements Under Various Proposals

Requiring Discounts Only for Non-LIS Beneficiaries

Some have asked about the rationale in AAF’s plan to extend the rebate requirement to drugs provided to low-income subsidy (LIS) beneficiaries, since it currently only applies to non-LIS beneficiaries. If LIS beneficiaries continued to be excluded from the rebate requirement and the policy were implemented with the intent of holding the pharmaceutical industry harmless relative to current law obligations, then the discount rate currently required in AAF’s proposal would have to be increased. Further, it has been noted that high-cost LIS beneficiaries use different types of drugs than non-LIS beneficiaries; thus, the rebates would be more narrowly targeted on specific drug classes, disproportionately hitting cancer, Multiple Sclerosis, and rheumatoid arthritis drugs.[3] Depending on a drug company’s portfolio, such a policy could be particularly harmful or it could allow for cost-shifting from one product to another, undermining the intent of the policy. But more uniform policy is less likely to create winners and losers.

Issues for Further Consideration

Impact of the Rebate Rule

When AAF’s proposal was put forward, the Trump Administration’s so-called “rebate rule” had not been proposed, and thus it was not accounted for in any of the modeling done at the time. While AAF has not yet conducted new modeling, this proposal and the rebate rule are expected, at least on their own, to have similar effects: slightly higher premiums for everyone and significant OOP savings for some. If both were to go into effect, premiums may increase enough to affect enrollment. Policymakers should carefully consider the combined effect before moving forward with both proposals.

If the rebate rule were implemented before this structural reform, it is almost certain that a lower OOP cap would be required to keep the overall spending that occurs before catastrophic coverage at roughly the same level, which in turn would keep expected manufacturer rebates at roughly the same level. Otherwise, less spending would occur in the catastrophic phase and manufacturers would be liable for less of the costs. There would, however, be no impact on beneficiary OOP spending if the OOP cap were kept at the same level.

It may also be true, however, that the structural changes proposed here—specifically, the OOP cap—may largely mitigate the need for or impact of the rebate rule. Both policies seek to reduce the OOP burden of high-cost drugs. And, more specifically, the rule has the largest impact on the OOP costs for drugs with coinsurance. To the extent that these drugs push a beneficiary into the catastrophic phase, the full value of the OOP reduction that would result from the rebate rule may exceed the beneficiary’s OOP liability under our proposal. In such an instance, the rebate may again be used for premium reduction. Thus, estimating the impact of the policies implemented in tandem is not likely as simple as adding the expected impact of each individually.

Effect of Price Increases by Manufacturers

Indeed, drug manufacturers may simply increase the prices of their drugs by the amount of the rebate they will be required to pay. In fact, prior work by AAF has argued that this phenomenon is likely already occurring as a result of the current CGDP, as well as the Medicaid Drug Rebate Program, the 340B Drug Discount Program, and the taxes imposed on pharmaceutical sales after passage of the Affordable Care Act. Mandatory discounts and taxes distort the market and increase prices, which is why this proposal is not a policy that would be beneficial apart from the current set of policies. That said, this proposal is less likely to encourage price inflation than the current structure because of the fact that the rebates increase along with the price of the drug, as explained earlier. In other words, there is less pay-off for a price increase under this proposal than under current law, which is the primary rationale for making this change.

Current Structure May be Discouraging Use of Lower-Cost Generics

The current benefit structure may also encourage use of higher-priced drugs as a result of the differences in insurer liability between brand-name and generic drugs. Insurers are currently responsible for just 5 percent of the cost of a brand-name or biosimilar drug in the coverage gap but 75 percent of the cost of a generic drug. Therefore, unless a brand-name drug costs more than 15 times more than the generic, the insurer will pay less for the brand-name drug in the coverage gap. Further, plans have no liability for LIS enrollees in the coverage gap, which MedPAC suggests may explain why LIS beneficiaries have lower generic utilization rates than non-LIS.[4]

Conclusion

In the 16 years since Congress created the Medicare Part D program, the prescription drug market, insurance structure, and pricing practices have changed. Patterns have emerged that make it clear the current system is encouraging undesirable behaviors that increase costs for the government and consumers. Reforming the benefit structure in a way that realigns the financial incentives of both the insurers and drug manufacturers may help to reverse these trends by putting downward pressure on drug prices. Such a substantial reform requires careful consideration of the many trade-offs that will result from those changes.

[1] http://us.milliman.com/insight/2018/Restructuring-the-Medicare-Part-D-benefit-with-capped-beneficiary-spending/

[2] http://www.medpac.gov/docs/default-source/default-document-library/options-to-increase-the-affordability-of-specialty-drugs-in-pt-d—final.pdf?sfvrsn=0 (Slide 12)

[3] http://medpac.gov/docs/default-source/reports/jun19_ch2_medpac_reporttocongress_sec.pdf?sfvrsn=0 (page 44)

[4] http://www.medpac.gov/docs/default-source/reports/jun19_ch2_medpac_reporttocongress_sec.pdf?sfvrsn=0 (page 42)